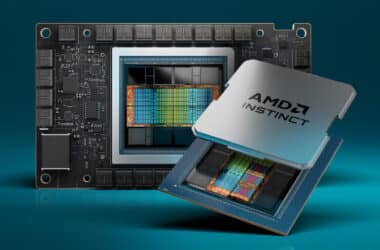

As the Thanksgiving-shortened week approaches, all eyes in the financial world are turning toward Nvidia, a tech giant that has been on an impressive rally throughout the year. The anticipation is palpable as investors ponder the sustainability of this November rally, particularly as we edge closer to the year-end. Nvidia’s upcoming earnings report, scheduled for Tuesday, will be a pivotal moment for the company and the broader market, with analysts and investors keen to decipher the signals it sends.

Anticipated Strong Q3 Results

Nvidia’s third-quarter results are highly anticipated, with analysts expecting robust performance. According to consensus estimates from FactSet, the chip giant is projected to have earned $3.37 per share on revenue of $16.19 billion. This revenue figure alone would surpass its own guidance of $16 billion for the quarter, a remarkable leap from the $5.9 billion recorded in the same period a year ago. This surge underscores the pivotal role that Nvidia’s graphics processing units (GPUs) have played in driving the growth of artificial intelligence (AI).

Evaluating Valuation and Forward Guidance

Despite the impressive gains of over 200% in its stock price this year, the critical question on investors’ minds revolves around Nvidia’s valuation and its future prospects. With such remarkable growth, some wonder if the chipmaker is overvalued. As the earnings report looms, market participants will closely scrutinize Nvidia’s guidance and forward-looking commentary to determine whether the bullish case around AI and the company’s future remains intact.

“I think the path of least resistance is still up,” says Timothy Arcuri, managing director at UBS, who covers Nvidia. “And I think it’s going to be a solid set of results.”

Market Rally and Concerns

Nvidia’s earnings report arrives amidst a broader market rally in November. The Dow Jones Industrial Average has gained over 5%, the S&P 500 has climbed more than 7%, and the Nasdaq Composite has advanced more than 9%. While this rally has been positive for many investors, concerns persist regarding Nvidia’s valuation compared to the broader market.

Valuation Concerns

Nvidia’s valuation, with a trailing 12-month price-to-earningsThe price-to-earnings ratio, often abbreviated as P/E ratio, is a fundamental metric used by investors and analysts to evaluate the relative value of a company's shares in the stoc... ratio at a staggering 118, stands in stark contrast to the S&P 500, which trades at a multiple of 22. The significant premium investors are paying for Nvidia stock raises questions about its sustainability and potential vulnerability to market corrections.

Impact of U.S. Export Restrictions and Competition

Another source of concern is the impact of U.S. restrictions on exports to China and the emergence of competition. The U.S. government’s export restrictions have raised questions about the demand for Nvidia chips. Additionally, Microsoft’s unveiling of custom AI chips to compete with Nvidia has added a layer of competition that warrants scrutiny.

Analyst and Investor Sentiment

Despite these concerns, investor sentiment remains largely bullish on Nvidia. The stock maintains a consensus buy rating among analysts. Piper Sandler analyst Harsh Kumar believes that Nvidia can navigate the challenges posed by China bans and that the launch of other AI services will only increase the demand for GPUs, potentially extending the longevity of the AI upcycle.

Resilience in the Face of Disappointment

Some market participants are of the view that any disappointment in Nvidia’s earnings report that results in a temporary dip in the stock price will likely be met with eager buyers looking to seize the opportunity. Quincy Krosby, chief global strategist at LPL Financial, describes Nvidia as an “essential, essential component of the AI story,” suggesting that the company’s significance in the AI sector is unlikely to wane.

Wall Street’s Positive Momentum

Nvidia’s earnings report arrives at a time when Wall Street has absorbed some positive news. Falling Treasury yields and cooler-than-expected October inflation data appear to have confirmed the Federal Reserve’s stance on halting rate hikes. This positive backdrop sets the stage for Nvidia’s report and its potential impact on market sentiment and trends.

Inflation Data and Fed’s Stance

The latest inflation data, which showed October’s consumer price indexThe Consumer Price Index is a measure of the average price level of a basket of goods and services that are commonly consumed by households. More and producer price index coming in cooler than expected, has provided reassurance to Wall Street. It indicates that the Federal Reserve may no longer pursue aggressive rate hikes, creating a more favorable environment for investors.

Bottom-line: As Nvidia’s earnings report looms large on the horizon, the financial world holds its breath in anticipation. The company’s remarkable journey, from significant gains in stock price to its pivotal role in the AI revolution, has made it a focal point of attention. While concerns about valuation, competition, and export restrictions persist, the consensus remains optimistic about Nvidia’s future.

In a market environment characterized by resilience and adaptability, Nvidia’s ability to navigate these challenges will be closely monitored. Whether the chip giant continues its ascent or faces headwinds, the importance of Nvidia in the AI narrative cannot be overstated. As the year draws to a close, Nvidia’s performance and guidance will provide valuable insights into the evolving landscape of technology and investment.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.