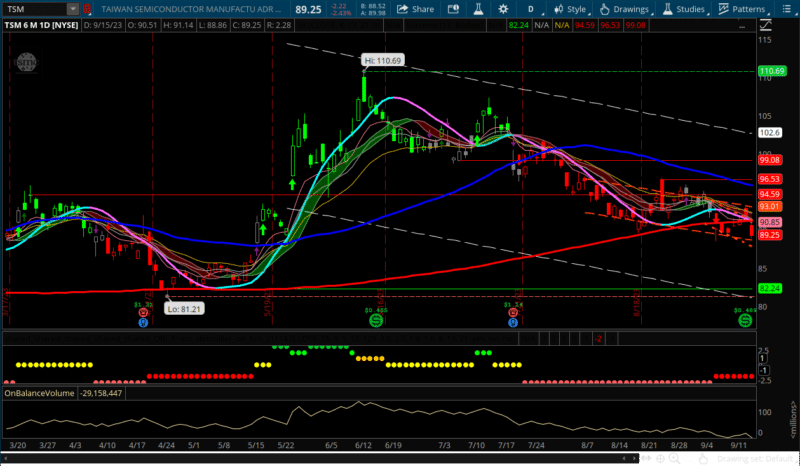

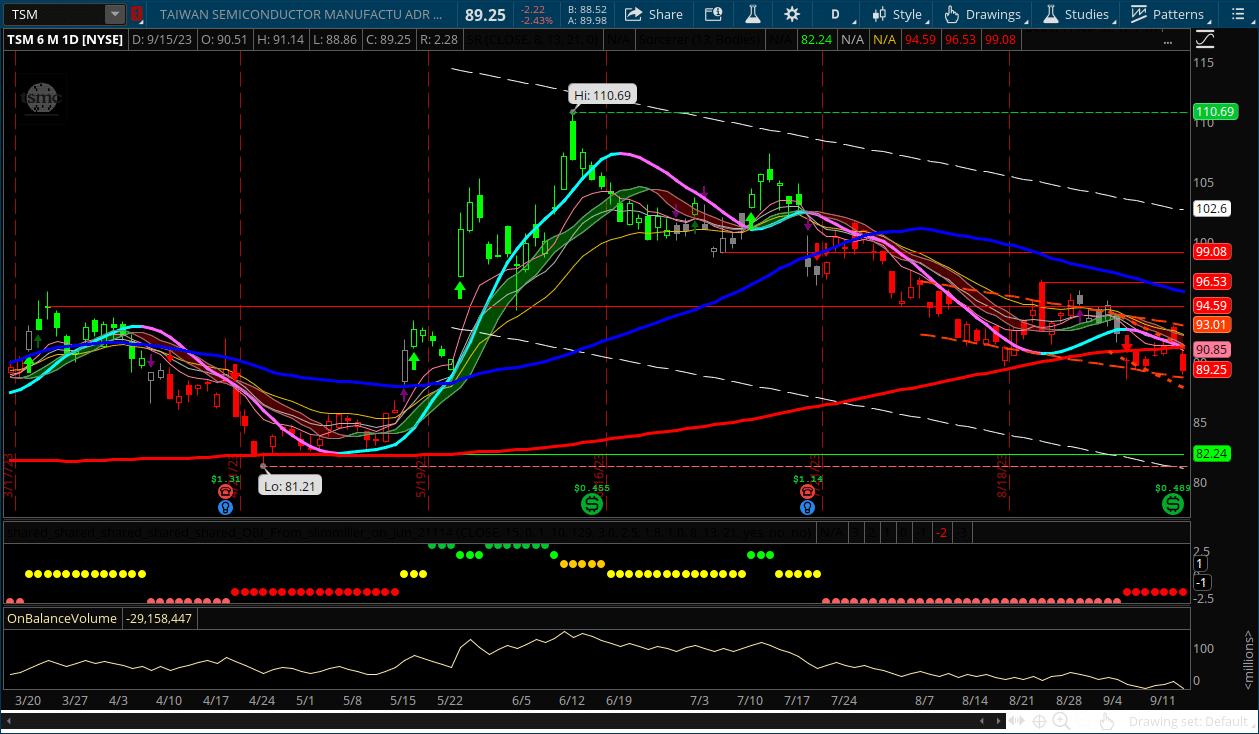

Taiwan Semiconductor TSM stock broke back below its 200 day moving average for the week ending September 15, 2023. TSM stock has a technical downtrend rating.

Chipmakers Are Slowing Down as Consumer Demand Drops

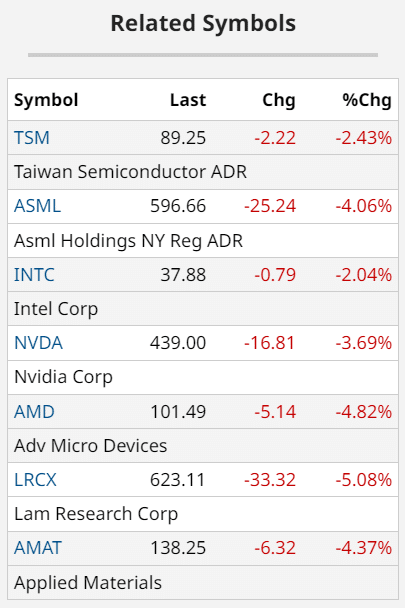

It’s not just TSM stock that took a beating last week. The entire semiconductor sector is being dumped on concerns that demand is slowing down for microchips.

Taiwan Semiconductor is rumored to have told its main suppliers to delay deliveries of high-end chip-making equipment as the world’s leading contract chip maker grows increasingly nervous about customer demand.

Weaker economic conditions, a slower recovery in China and slower end-market demand are forcing customers to be more cautious. There is a slowdown in sales of mobile phones, laptops, industrial and, more recently, automotive chips. That’s a lot of end markets that are slowing down.

Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s largest semiconductor manufacturing company. It is involved in the production and sale of integrated circuits (ICs) and semiconductors. TSMC fabricates chips for a wide range of applications, including consumer electronics, automotive, telecommunications, and industrial equipment. The company offers a variety of advanced chip technologies, such as 5nm, 7nm, and 16nm processes, and works with numerous global tech giants to manufacture their semiconductor designs. TSMC plays a crucial role in the global semiconductor industry, supplying chips to companies involved in the production of smartphones, computers, gaming consoles, and other electronic devices.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.