Albemarle’s (ALB) stock is declining due to several key factors. The sharp drop in lithium prices, driven by reduced demand for electric vehicles, has significantly impacted the company. Earnings are expected to plummet from $7.33 per share last year to $0.58 per share. The company’s recent announcement to issue up to $2.3 billion in preferred equity is seen as dilutive to current shareholders. Operating income has fallen by 70%, and gross profitIn the world of finance and accounting, the term "gross profit" holds significant importance as it provides a fundamental snapshot of a company's financial health. Also known as gr...<profit marginsIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as... have dropped from 49.6% to 23.6%. Revenue forecasts for 2024 are significantly lower, contributing to concerns about Albemarle’s profitability and growth prospects. Despite these challenges, some analysts believe the stock might be undervalued with potential for recovery if lithium prices rebound.

Several other companies in the lithium industry, including SQM, Livent Corporation, Ganfeng Lithium, Pilbara Minerals, and Lithium Americas, are facing similar challenges due to falling lithium prices. This price decline is causing these companies to reassess their production plans, financial forecasts, and expansion strategies. EV manufacturers like Tesla and BYD are also indirectly affected by lithium price fluctuations.

Declining Lithium Prices

Impact on Albemarle

One of the most significant factors driving the decline in Albemarle’s stock is the sharp drop in lithium prices. The reduced demand for electric vehicles (EVs), which rely heavily on lithium for their batteries, has led to a surplus in the market, causing prices to plummet. This decrease in lithium prices has severely impacted Albemarle’s revenue and profitability, creating uncertainty about the company’s future earnings potential.

Industry-Wide Challenges

Albemarle is not alone in facing these challenges. Other major players in the lithium industry, such as SQM, Livent Corporation, Ganfeng Lithium, Pilbara Minerals, and Lithium Americas, are also grappling with the effects of falling lithium prices. These companies have had to reassess their production plans, expansion strategies, and financial forecasts to navigate the current market conditions.

Reduced Earnings and Dilutive Share Issuance

Wall Street’s Consensus Estimate

Albemarle’s financial performance has deteriorated significantly, with Wall Street’s consensus estimate for earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... dropping to 58 cents, a stark contrast to $7.33 a year ago. This dramatic decline in earnings has shaken investor confidence and contributed to the stock’s downward trajectory.

Dilutive Share Issuance

In a move that has further concerned investors, Albemarle recently announced plans to issue up to $2.3 billion in preferred equity. This decision is viewed as highly dilutive to current common equity shareholders, adding to the negative sentiment surrounding the stock.

Falling Operating Income and Margin Compression

Operating Income Decline

Albemarle’s operating income has taken a significant hit, tumbling by approximately 70% from $1.1 billion in Q1 2023 to $373 million in the most recently reported quarter. This steep decline reflects the broader challenges the company is facing in maintaining its profitability amidst falling lithium prices.

Gross Profit Margin Slump

The company’s gross profit marginWhen it comes to evaluating a company's financial well-being, one of the fundamental metrics that analysts and investors rely on is the gross profit margin. This metric provides va... has also suffered, dropping from 49.6% in Q1 2023 to 23.6% in Q2 2023, the lowest level in the past 12 quarters. This margin compression highlights the increasing costs and pricing pressures that Albemarle is dealing with in the current market environment.

Reduced Revenue Forecast

2024 Revenue Expectations

Despite ending 2023 with record sales of $9.6 billion, Albemarle has revised its revenue forecast for 2024 to a range of $6.9 billion to $7.6 billion. This significant reduction, even at the highest projected lithium prices, underscores the challenges the company faces in achieving its financial targets.

Investor Concerns and Potential for Recovery

Near-Term Profitability Concerns

These factors have collectively contributed to growing investor concerns about Albemarle’s near-term profitability and growth prospects. The sharp decline in earnings, dilutive share issuance, falling operating income, margin compression, and reduced revenue forecast have all played a role in the stock’s decline.

Analyst Perspectives

Despite the current challenges, some analysts still view Albemarle’s stock as undervalued, with potential for recovery if lithium prices rebound. The company’s strategic initiatives and market positioning could offer a pathway to improved financial performance in the future, provided that market conditions stabilize.

Broader Impact on the Lithium Industry

Challenges for Other Lithium Producers

The falling lithium prices have created a ripple effect across the industry. Companies like SQM, Livent Corporation, Ganfeng Lithium, Pilbara Minerals, and Lithium Americas are all experiencing similar challenges. These firms have had to adjust their production levels, reassess expansion plans, and revise financial forecasts to align with the current market realities.

Impact on EV Manufacturers

Electric vehicle manufacturers, including Tesla and BYD, are also indirectly affected by lithium price fluctuations. While lower lithium prices can reduce battery costs, the overall market volatility and supply chain disruptions pose significant challenges for these companies.

Insights

- Albemarle’s earnings and profitability are under significant pressure due to declining lithium prices.

- The planned issuance of preferred equity is seen as dilutive, impacting shareholder value.

- The lithium industry is experiencing widespread challenges, with many companies revising their strategies.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

- Declining Lithium Prices: Core topic affecting the entire industry, leading to reduced earnings and profitability for major lithium producers like Albemarle.

- Dilutive Share Issuance: Albemarle’s $2.3 billion preferred equity issuance is negatively impacting current shareholders.

- Falling Operating Income and Margins: Significant drops in operating income and gross profit margins are critical indicators of financial distress.

- Reduced Revenue Forecast: Lower projected sales for 2024 highlight the ongoing market challenges and reduced demand.

The Guerilla Stock Trading Action Plan

- Monitor Lithium Prices: Keep a close watch on lithium market trends to gauge potential recovery.

- Evaluate Investment Impact: Assess the effects of preferred equity issuance on share value and investment strategy.

- Review Financial Reports: Regularly analyze Albemarle’s financial statementsFinancial statements are the primary tool used by investors to evaluate a company's financial health. They are an important part of a company's reporting, providing a snapshot of i... More for signs of stabilization or further decline.

- Diversify Investments: Consider diversifying investments within the energy sector to mitigate risks associated with lithium market volatility.

Blind Spots

Market Volatility and Long-term Demand: The potential for rapid changes in the lithium market and long-term demand for electric vehicles could alter the current negative outlook.

Technological Advancements in Battery Alternatives: The potential development and adoption of alternative battery technologies, such as solid-state batteries or other innovations, could significantly impact the demand for lithium, posing a long-term risk to lithium producers like Albemarle.

Geopolitical Risks: The lithium market is heavily influenced by global trade policies and geopolitical tensions. Any changes in trade agreements, tariffs, or political instability in key lithium-producing regions could disrupt supply chains and affect market stability, impacting companies dependent on lithium.

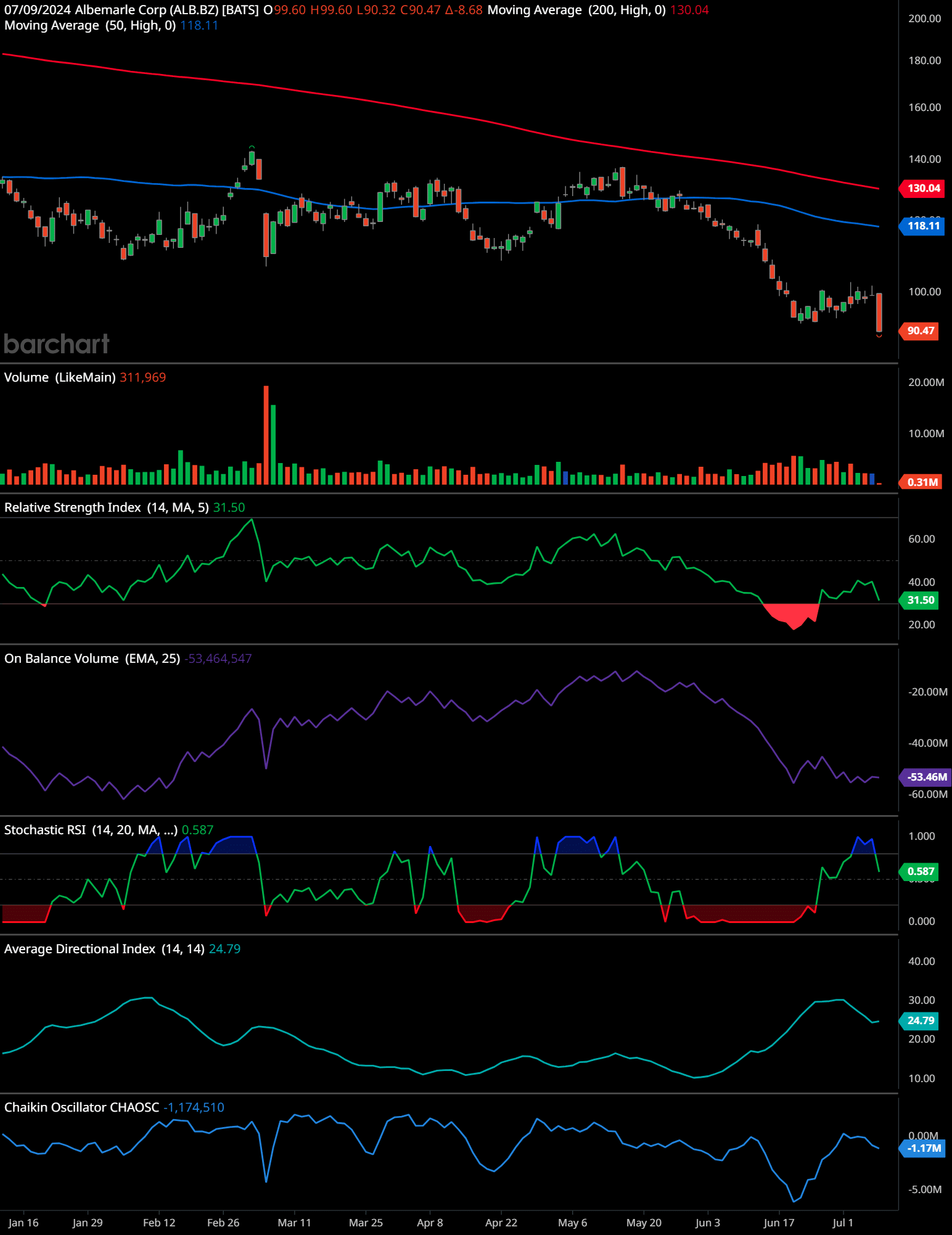

ALB Technical Analysis

Price Movement: The stock price is currently at $90.47, having dropped $8.68 in the latest session. The price is below both the 50-day moving average ($118.11) and the 200-day moving average ($130.04), indicating a bearish trend. The recent candles show a sharp decline, suggesting increased selling pressure.

Volume: The volume spike indicates significant selling activity. The volume bar is noticeably higher than previous sessions, which typically suggests strong bearish sentiment.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 31.50, indicating that the stock is nearing oversold territory. This could suggest a potential bounce if buyers step in, but it also confirms the current bearish momentum.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is trending downward, which aligns with the price decline and indicates that the overall volume flow is negative, supporting the bearish outlook.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.587, which suggests the stock is oversold. This could indicate a potential for a short-term reversal, but the overall trend remains bearish.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 24.79, below 25, suggesting that the current trend is weak. However, given the downward price action, it is leaning towards a bearish trend.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -1,174,510, indicating strong bearish momentum. This oscillator supports the view that there is significant selling pressure.

Time-Frame Signals:

- 3-Month Outlook: Sell

- 6-Month Outlook: Hold

- 12-Month Outlook: Hold

The stock is currently in a bearish trend with significant selling pressure. While some indicators suggest it is oversold, the overall trend does not show signs of reversal yet. Therefore, a “Sell” recommendation is prudent in the short term, with a “Hold” in the medium to long term as the stock may stabilize.

Past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The decline in Albemarle’s stock is a reflection of broader challenges in the lithium market. The sharp drop in lithium prices, reduced earnings, dilutive share issuance, falling operating income, margin compression, and a lowered revenue forecast have all contributed to the company’s current struggles. As the industry navigates these turbulent times, the potential for recovery remains contingent on market conditions and strategic responses from key players. The volatility of the lithium market underscores the importance of balancing supply with demand in a rapidly evolving industry.

Albemarle Stock FAQ

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.