Frequency Electronics (FEIM) has experienced notable stock price growth due to various positive developments. Following a management change in 2022, the company saw a 29.2% year-over-year quarterly sales growth, with Q2 revenue reaching $15.6 million and EPS rising to 28 cents from 3 cents the previous year. The fiscal year 2024 saw revenue growth of 36%, totaling $55.3 million, and a record backlog of $78 million. The CEO, Tom McClelland, attributes this to improved internal management, a stronger product lineup, and a customer-focused strategy. The company’s share price has increased by 40% over the last year, outperforming the market. They secured significant new contracts worth $53 million, promising to boost quarterly revenue by $5.5 million over the next two years. Targeting a 50% gross marginGross margin is a critical financial metric that plays a pivotal role in evaluating a company's financial health and profitability. It is a percentage that indicates how efficientl... within a year, up from 30%, Frequency Electronics is poised for further profitability. Analysts suggest the stock might still be undervalued, indicating potential for continued growth.

Improved Financial Performance

Management Overhaul and Revenue Growth

Since the change in management in 2022, Frequency Electronics has seen a remarkable improvement in its financial performance. The company’s quarterly sales growth year-over-year stands at an impressive 29.2%. This growth is a testament to the effective strategies implemented by the new leadership.

In the most recent quarter, Frequency Electronics reported an EPS of 28 cents, a substantial increase from the 3 cents reported in the same quarter last year. Additionally, Q2 revenue grew to $15.6 million, up from $13 million in the previous year. These figures highlight the company’s trajectory toward sustained financial health and profitability.

CEO’s Perspective on Financial Success

Tom McClelland, President and CEO of Frequency Electronics, expressed his optimism regarding the company’s financial future. He noted, “In fiscal year 2024, we experienced steady revenue growth of 8-10% quarter over quarter for the entire year, with revenue year over year up by 36%. Revenue for FY2024 was $55.3 million, up from $40.8 million in FY2023.”

McClelland emphasized the importance of disciplined internal management and a fortified product offering as key drivers of their improved operating income. The company’s backlog at the end of the fiscal year stood at $78 million, a historical high, signaling a strong business environment and a customer-focused strategy. Looking ahead, McClelland remains optimistic about continued growth and sustained profitability.

Strong Stock Performance

Market Outperformance

Frequency Electronics’ stock price has surged by 40% over the past year, significantly outperforming the overall market return. This strong performance reflects investor confidence in the company’s strategic direction and financial health.

New Contracts Fueling Growth

Major Contract Wins

In November, Frequency Electronics announced a series of major contracts totaling $53 million, approximately equivalent to their revenue over the last 12 months. Two of these contracts, worth $44 million, are scheduled for delivery over the next two years, potentially adding $5.5 million in revenue per quarter. These contracts not only bolster the company’s revenue prospects but also solidify its position in the market.

Improved Profit Margins

Targeted Margin Improvements

The company’s CEO has set an ambitious target for improving gross margins. Currently, at 30%, the goal is to reach around 50% within the next six months to a year. Achieving this target, coupled with expected revenue growth, could lead to substantially improved profitability for Frequency Electronics.

Positive Outlook

Strong Backlog and Revenue Prospects

With a robust backlog and new contracts in place, Frequency Electronics is poised for continued revenue growth. The anticipated increase in gross margins to 50% could significantly enhance the company’s bottom line, providing a solid foundation for future financial success.

Undervalued Potential

Analysts’ Perspective

Some analysts believe that the recent positive developments in Frequency Electronics’ business are not yet fully reflected in its stock price. This suggests that there may be further upside potential for the stock, making it an attractive option for investors.

Insights

- Management changes in 2022 led to significant financial improvements.

- Record backlog and strong new contracts bolster future revenue.

- Targeting higher profit marginsIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as... could substantially enhance profitability.

- Analysts see further upside potential in the stock.

The Essence (80/20)

- Improved Financial Performance: Post-management change, the company saw substantial revenue and profitability increases, highlighted by a 36% year-over-year growth in FY2024.

- Strong Stock Performance: FEIM’s stock rose by 40% in the past year, outperforming the market due to improved financial metrics and strategic contracts.

- New Contracts and Revenue Growth: Major contracts worth $53 million, with scheduled deliveries enhancing quarterly revenues, support future growth.

- Targeted Profit Margins: Aiming to increase gross margins from 30% to 50%, which would significantly improve profitability.

The Action Plan – What Frequency Electronics Will Do Next

- Enhance Management Practices: Continue focusing on disciplined internal management and product offering improvements.

- Leverage Contracts: Ensure timely delivery and execution of new contracts to maintain revenue growth.

- Margin Improvement: Implement strategies to achieve the targeted 50% gross margin within the next year.

- Investor Communication: Highlight undervalued stock potential to attract more investor interest.

Blind Spots

Market Conditions: Potential macroeconomic factors or industry-specific changes that could impact future performance are not thoroughly addressed.

Dependency on Key Contracts: Frequency Electronics’ recent growth heavily relies on a few significant contracts. Any delays or issues in the execution of these contracts could adversely affect their revenue and profitability projections.

Technological Disruption: The company operates in a highly competitive and rapidly evolving technology sector. Failure to innovate or keep pace with technological advancements could result in losing market share to more agile competitors.

FEIM Technical Analysis

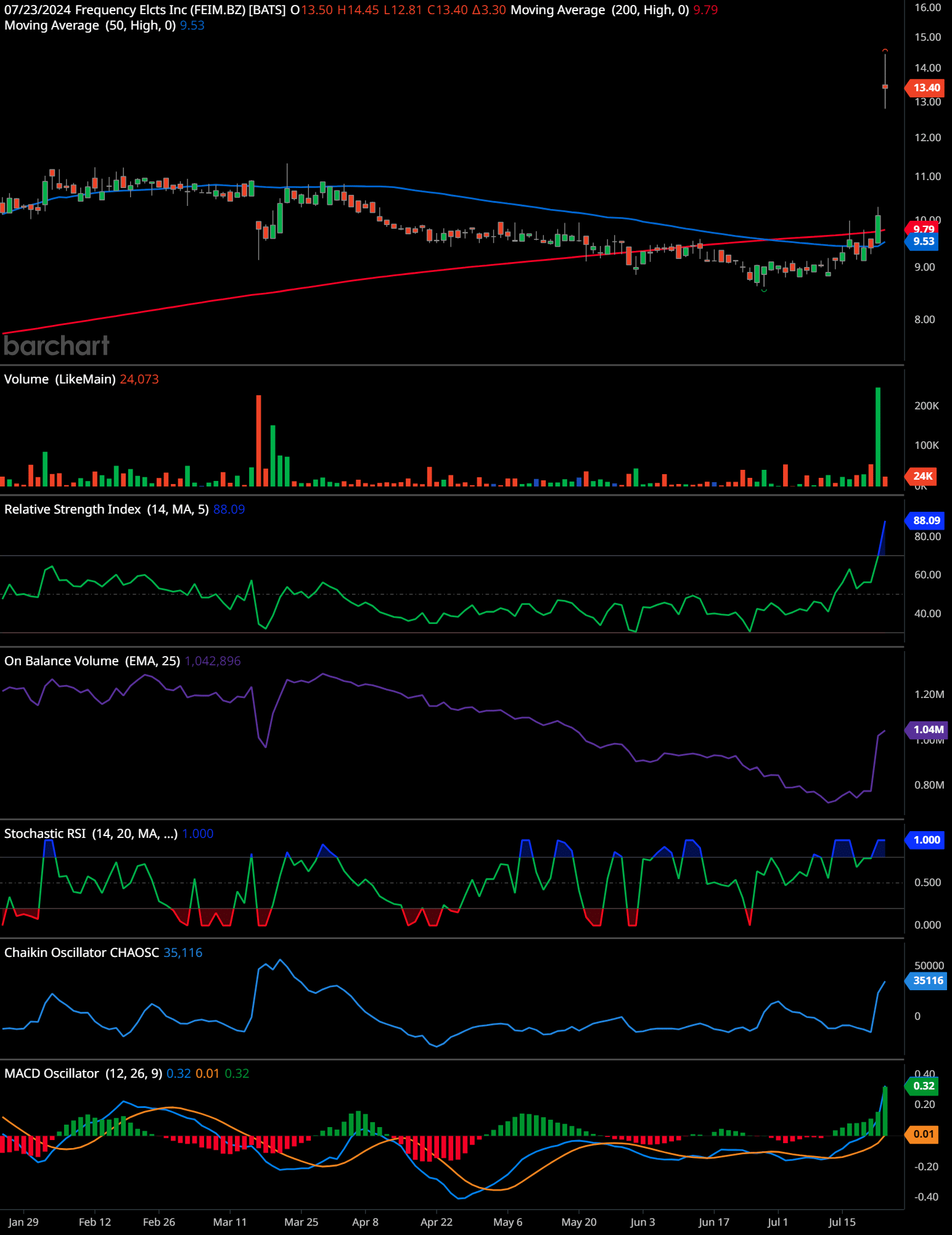

The chart for Frequency Electronics Inc. (FEIM) shows the following technical analysis:

Trend Analysis: The stock has been in a long-term downtrend, as indicated by the 200-day moving average (blue line) trending downward. Recently, there has been a significant price spike, breaking above the 50-day moving average (red line), suggesting a potential reversal.

Support and Resistance Levels: The stock found support around the $9.00 level, as evidenced by multiple bounces from this price point. Resistance is now likely around the $13.50 mark, which is the recent high.

Volume Analysis: A substantial increase in volume accompanies the recent price spike, indicating strong buying interest. This surge in volume adds credibility to the upward price movement.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 88.09, which is in overbought territory. This suggests that the stock may be due for a pullback or consolidation in the near term.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV has turned upward sharply, indicating that the recent price rise is backed by strong volume, a positive sign for the stock’s momentum.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 1.00, indicating overbought conditions. Similar to the RSI, this suggests the stock might be overextended in the short term.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator has spiked, reflecting increased accumulation and suggesting bullish sentiment.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator: The MACD has crossed above the signal line, and both lines are trending upward, confirming the recent bullish momentum.

Time-Frame Signals:

- 3 Months: Hold. The recent surge and overbought indicators suggest a potential short-term pullback.

- 6 Months: Buy. The breakout and strong volume indicate a potential for continued upward movement.

- 12 Months: Buy. If the trend reversal holds, the stock could continue to rise over the long term.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The recent surge in Frequency Electronics (NASDAQ: FEIM) stock is a result of improved financial performance, strong new contracts, targeted profit margin improvements, and a positive business outlook. The company’s strategic initiatives and effective management have positioned it well for sustained growth and profitability. As investor interest continues to grow, Frequency Electronics’ stock is likely to remain a strong performer in the market.

Frequency Electronics (FEIM) Stock FAQs

Frequently Asked Questions

- 1. What recent financial performance improvements has Frequency Electronics experienced?

- The company has seen a substantial increase in revenues, margins, and profitability following a change in management in 2022. Recent quarterly sales growth was reported at 29.2% year-over-year.

- 2. How did Frequency Electronics perform in Q2 of the current fiscal year?

- In Q2, the company reported an EPS of 28 cents, compared to 3 cents last year, and revenue of $15.6 million, up from $13 million the previous year.

- 3. What has Frequency Electronics’ CEO said about their recent performance?

- CEO Tom McClelland commented on the steady revenue growth of 8-10% quarter over quarter for the entire fiscal year 2024, with revenue year over year up by 36%. He expressed optimism about continued growth and profitability.

- 4. What is the current backlog for Frequency Electronics?

- The backlog at the end of the fiscal year ending April 30, 2024, was $78 million, representing a historical high for the company and indicative of a strong business environment.

- 5. How has the stock price of Frequency Electronics performed recently?

- The share price is up 40% in the last year, outperforming the overall market return.

- 6. What new contracts has Frequency Electronics secured?

- In November, the company announced major contracts totaling $53 million, with $44 million scheduled for delivery over the next two years, potentially adding $5.5 million in revenue per quarter.

- 7. What are the company’s targeted profit margins?

- The CEO has stated they are targeting a gross margin of around 50% within the next six months to a year, up from their current 30% margin.

- 8. What is the positive outlook for Frequency Electronics?

- With a strong backlog and new contracts, the company’s revenue is expected to grow. Achieving the targeted 50% gross margin could significantly boost profitability.

- 9. Why do some analysts believe Frequency Electronics stock is undervalued?

- Analysts believe the recent business improvements are not yet fully reflected in the stock price, suggesting there may be further upside potential.

- 10. What factors have contributed to increased investor interest in Frequency Electronics?

- Improved financial performance, strong stock performance, new contracts, improved profit margins, and a positive outlook have driven increased investor interest and positive sentiment.

- 11. How much revenue did Frequency Electronics report for fiscal year 2024?

- Revenue for FY2024 was $55.3 million, up from $40.8 million in FY2023.

- 12. What is the company’s commitment going forward?

- The company remains committed to achieving sustained profitability and strong cash generation, with a focus on providing important solutions to enhance life and protect the country and its allies.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.