Volcon Inc. (VLCN), a player in the electric vehicle (EV) sector, has recently experienced a noticeable surge in its stock price. This movement appears driven by several factors that are more technical and speculative than fundamentally driven. Investors and market watchers are advised to approach such stocks with caution, given the inherent volatility and the potential for rapid price changes.

Key Drivers of Volcon’s Stock Volatility

Penny Stock Dynamics

Volcon is categorized as a penny stock, characterized by its low share price and small market capitalization. Such stocks are notoriously volatile, capable of significant percentage swings based on relatively minor trading volumes. This inherent instability makes penny stocks like Volcon attractive to traders looking for quick gains, but it also increases the risk of substantial losses.

Speculative Trading and Market Movements

A large portion of the recent activity in Volcon’s stock appears to be speculative. The company has not released any significant news or fundamental developments that would typically justify such a price increase. This suggests that the stock’s recent performance may be influenced by momentum trading strategies or even pump-and-dump schemes, where prices are artificially inflated before being sold off by early holders at a profit.

Impact of a Low Float

Volcon’s market dynamics are also affected by its low float, which consists of about 250,000 shares. This limited availability can lead to exaggerated market movements as even modest buy orders can push prices significantly higher, contributing to the stock’s volatility.

Consequences of Reverse Stock Split

On June 6, 2024, Volcon undertook a 1-for-100 reverse stock split, reducing its outstanding shares from approximately 33.3 million to just 0.33 million. Such corporate actions can lead to increased stock volatility as the market adjusts to the new share structure and perceived scarcity of shares.

Potential for a Short Squeeze

The combination of high volatility and a low float can set the stage for a short squeeze, a scenario where short sellers are forced to buy back shares to cover their positions as prices rise, further driving up the stock price temporarily.

Broader Market Interest in EV Sector

Despite the lack of company-specific catalysts, Volcon may be riding the wave of general market enthusiasm for electric vehicles. As investors continue to show interest in green technologies and sustainable solutions, even smaller players in the sector like Volcon can benefit from the increased attention and investment flowing into EV stocks.

VLCN Technical Analysis

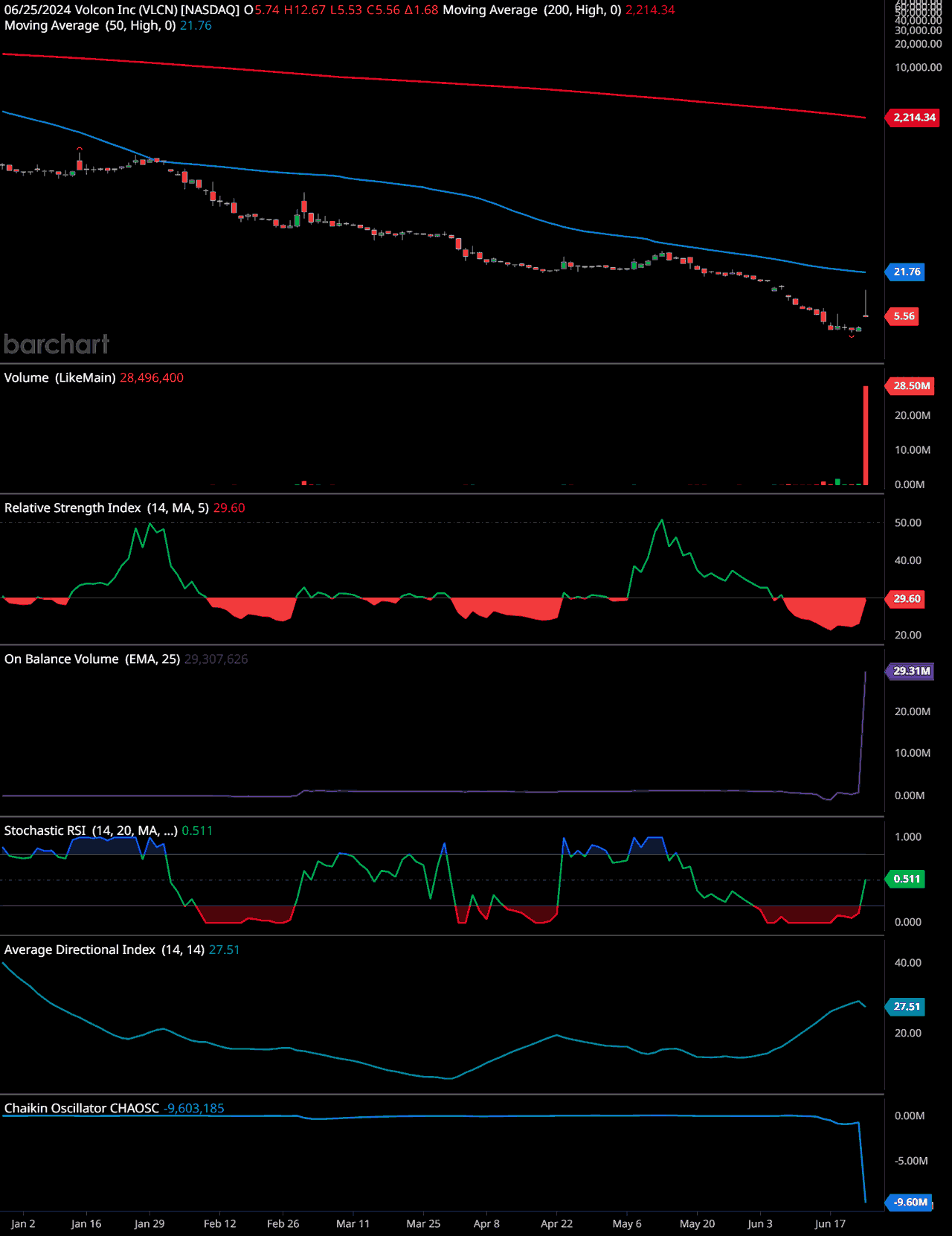

Price Trend: The stock price has been in a consistent downtrend since January, with lower highs and lower lows. The 50-day moving average (21.76) and the 200-day moving average (2214.34) are both sloping downwards, confirming the bearish trend.

Support and Resistance: There is a visible resistance level at around 5.56, where the stock recently closed. The support level is difficult to pinpoint exactly due to the consistent downtrend, but it appears there might be some minor support around 1.68.

Volume: There was a significant spike in volume on the last trading day, with 28,496,400 shares traded. This is a substantial increase from the average volume, indicating heightened interest or a reaction to news.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is currently at 29.60, which is in the oversold territory (below 30). This suggests that the stock might be due for a short-term rebound or consolidation.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV has recently spiked to 29,307,626, indicating strong buying pressure. This could be a positive sign if it continues, as it suggests that accumulation is happening despite the downtrend.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.511, indicating that the stock is neither overbought nor oversold at this moment. It is in a neutral position, suggesting a potential for either continuation of the trend or a reversal.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 27.51, which suggests a strong trend is in place. Generally, an ADX above 25 indicates a strong trend, and in this case, it supports the ongoing downtrend.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -9,603,185, indicating strong bearish momentum. This aligns with the downtrend observed in the stock price.

Based on these indicators, the overall technical analysis suggests the following investment recommendations:

- 3-Month Horizon: Sell. The ongoing downtrend, strong bearish momentum, and the high volume spike suggest further downside risk in the short term.

- 6-Month Horizon: Hold. There might be some stabilization or potential for a reversal, especially if the stock remains oversold and accumulation continues.

- 12-Month Horizon: Hold. While the long-term trend is still uncertain, if the company fundamentals improve or market conditions change, there might be a potential for recovery.

Investors should keep an eye on any news or changes in the technical indicators, particularly the volume and RSI, for signs of a trend reversal.

Keep in mind that past performance does not indicate future outcomes. It’s essential to do your own research and consider speaking with a financial advisor before making any investment decisions. 🧡

Investor Caution Advised

The technical and speculative nature of Volcon’s recent stock performance highlights the risks associated with investing in such volatile securities. The lack of fundamental support for the price increase, coupled with the potential for manipulative trading practices, suggests that the stock’s current valuation might not accurately reflect the company’s underlying value or future prospects.

Investors considering penny stocks, particularly those as volatile as Volcon, should be aware of the risks and potential for significant financial losses. The allure of quick profits can be tempting, but the price swings are often unpredictable and can result in substantial losses just as quickly as gains.

In conclusion, while Volcon’s stock may continue to experience rapid price movements, these are likely more reflective of market speculation and less of the company’s actual performance or potential. Investors should conduct thorough due diligence and consider the high-risk nature of such investments before committing capital to penny stocks like Volcon.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.