Market Downturn and Economic Concerns

Investors are gearing up for a challenging week following a significant sell-off in key stock averages last Friday. The Nasdaq Composite (COMP:IND) slid into correction territory after the release of the July jobs report, sparking fears of a looming recession in the U.S. economy and concerns that the Federal Reserve is behind the curve in cutting interest rates. The broader market continued its retreat, with the S&P 500 (SP500) falling 2.5% for the week, experiencing losses in three out of five sessions. This marks the first three-week losing streak for the benchmark index since April.

Big Tech Struggles

Big tech names remained in the spotlight this week, predominantly for negative reasons. The tech-focused Nasdaq Composite (COMP:IND) saw a more significant decline of 4.3%, as many companies released Q2 reports that failed to meet investor expectations.

Amazon’s Mixed Results

Amazon.com (NASDAQ:AMZN) ended the week down nearly 7% after delivering mixed Q2 results and a Q3 outlook that fell short of analyst expectations. Despite the overall disappointment, Amazon Web Services (AWS) provided a silver lining with better-than-expected revenue growth, expected to be a key margin driver for the remainder of the year.

Intel’s Major Setbacks

Intel (NASDAQ:INTC) experienced a dramatic plunge of nearly 32% for the week. The chipmaker reported weaker-than-expected Q2 earnings, suspended its dividend starting Q4, slashed capital expenditures, and announced layoffs affecting over 15% of its workforce as part of a $10 billion cost reduction plan. Additionally, Intel released a disappointing Q3 outlook, with both top and bottom lines significantly below consensus estimates.

Microsoft’s Earnings Report

Microsoft (NASDAQ:MSFT) initiated a week of Big Tech earnings reports from the Magnificent 7 but ended the five-day trading period down 5.4%. Although the tech giant’s fiscal Q4 results surpassed expectations, Azure’s growth was weaker than anticipated. Furthermore, Microsoft’s Q1 revenue projections fell short of consensus estimates, although the company expects Azure growth to accelerate in the second half of the year.

Advanced Micro Devices’ Decline

Advanced Micro Devices (NASDAQ:AMD) saw a decline of 6.2% this week, erasing gains from a better-than-expected Q2 performance and Q3 outlook. Following the results, analysts expressed caution about the chipmaker’s ability to return to growth after a challenging July. Concerns persist over the state of the PC CPU channel and AMD’s ability to compete with Nvidia (NASDAQ:NVDA) and Intel (INTC) in the AI sector.

Nvidia Under Investigation

Nvidia (NVDA) also faced a tough week, with its stock down nearly 6%. The company became the focus of a U.S. Department of Justice (DoJ) probe into anti-competitive practices. The investigation was triggered by complaints from rivals that Nvidia allegedly abused its market dominance in selling chips that power AI products. The DoJ has reached out to multiple competitors, including AMD and various AI chip startups.

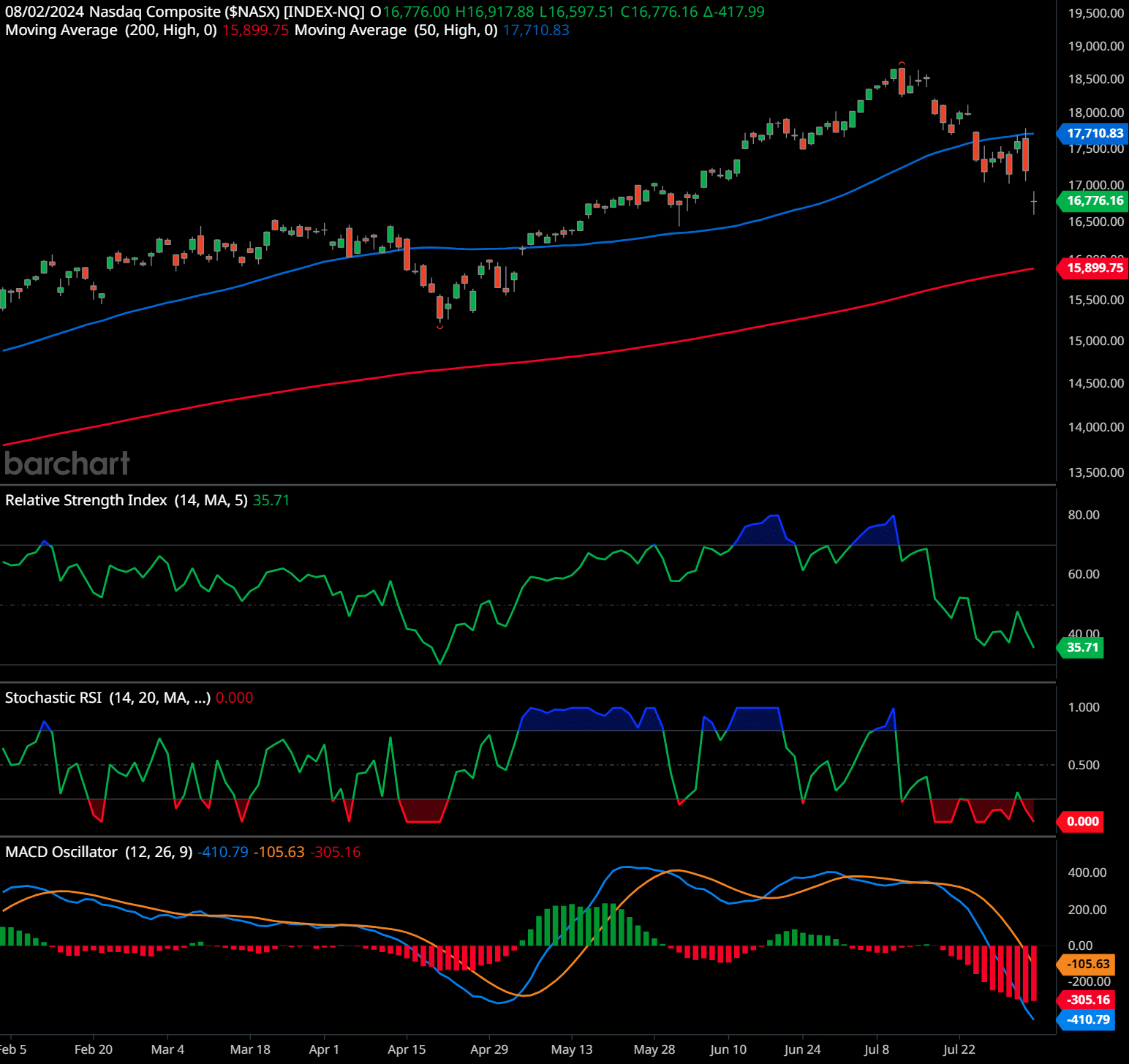

Nasdaq Composite Technical Analysis Daily Time Frame

The chart shows the daily performance of the Nasdaq Composite Index ($NASX) with three technical indicators: Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI), Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ..., and Moving Average Convergence Divergence (MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More).

Price Analysis: The index is currently trading at 16,776.16, below the 50-day moving average (17,710.83) but above the 200-day moving average (15,899.75). This suggests the recent trend has been downward, with the index encountering resistance around the 50-day moving average. The recent candlestick patterns indicate some volatility with alternating bullish and bearish days.

Relative Strength Index (RSI): The RSI is at 35.71, which is in the lower range but not yet in the oversold territory. This indicates some bearish momentum, but the index is not extremely oversold.

Stochastic RSI: The Stochastic RSI is at 0.000, indicating extremely oversold conditions. This suggests the index could be due for a short-term bounce or reversal, as the Stochastic RSI often signals a potential change in momentum when at such extreme levels.

MACD: The MACD line (blue) is significantly below the signal line (orange), with values at -410.79 and -105.63, respectively. The histogram is also showing deep red bars, indicating strong bearish momentum. The downward crossover and the divergence between the MACD and signal line suggest continued downward pressure.

Support and Resistance: Immediate support is around the 200-day moving average at 15,899.75. Resistance is around the 50-day moving average at 17,710.83.

Time-Frame Signals

3-Month: Sell. The current bearish momentum and indicators suggest continued downward pressure in the short term.

6-Month: Hold. If the index finds support at the 200-day moving average and shows signs of reversal, it could stabilize or recover.

12-Month: Buy. Long-term trends often revert to the mean, and the current levels could represent a buying opportunity if the broader market and economic conditions improve.

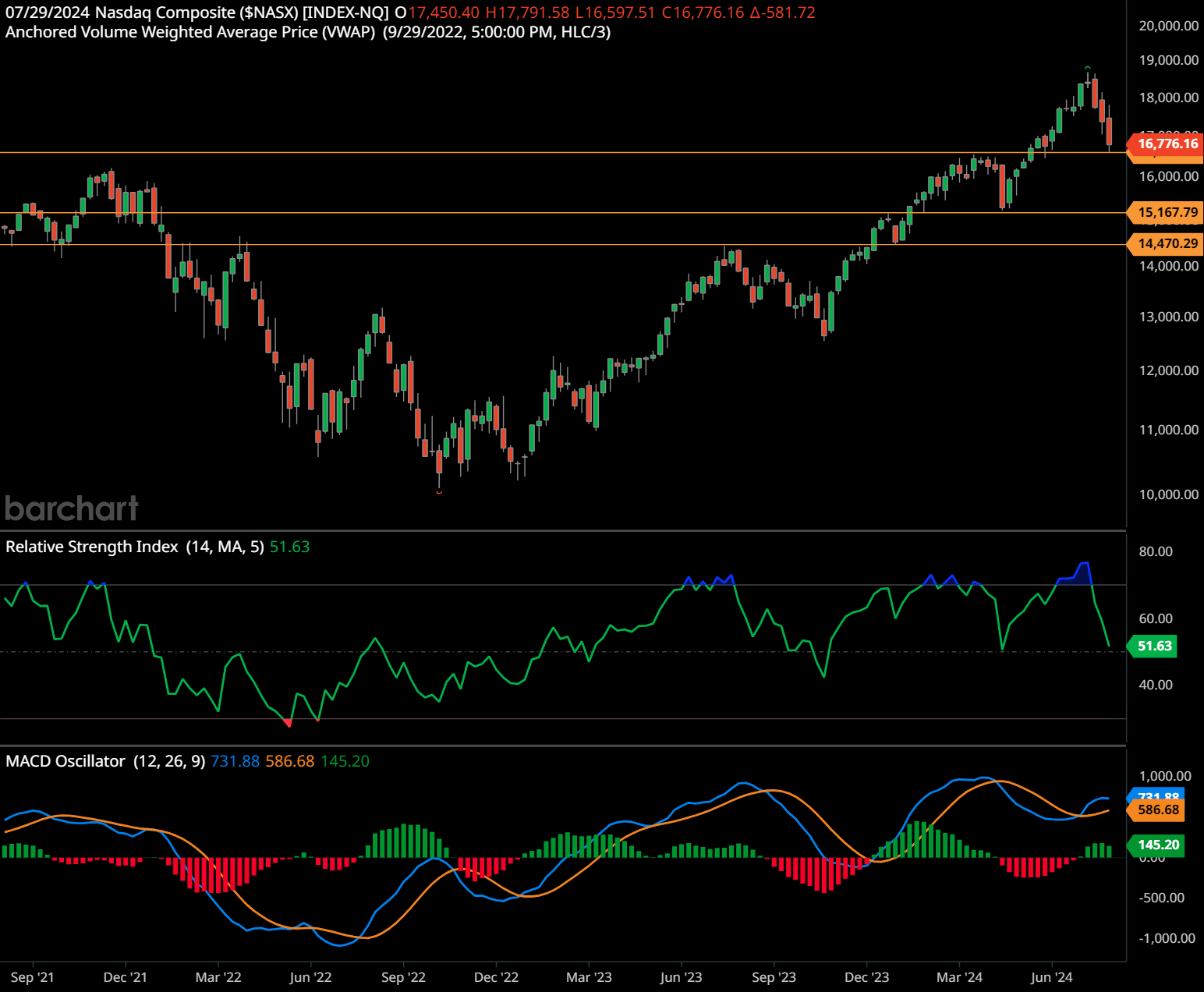

Nasdaq Composite Technical Analysis Weekly Time Frame

This chart represents the Nasdaq Composite Index over a weekly time frame.

Key Observations:

Trend Analysis: The Nasdaq Composite has been in an overall uptrend since mid-2022, showing a significant recovery from its lows around 10,000.00. The recent weeks, however, show a pullback from the high of approximately 18,000.00, indicating a potential correction phase.

Support and Resistance Levels: The chart highlights key support and resistance levels. Immediate support is around 16,776.16, with additional supports at 15,167.79 and 14,470.29. The resistance level is near the recent high of 18,000.00.

Relative Strength Index (RSI): The RSI is at 51.63, indicating a neutral stance. An RSI above 70 typically indicates overbought conditions, while below 30 indicates oversold conditions. The current level suggests neither extreme, providing no clear buy or sell signals.

MACD Oscillator: The MACD lines are converging with the MACD line above the signal line, but the histogram is showing a weakening trend. This suggests that while the longer-term trend is positive, the recent momentum is weakening, hinting at a possible bearish crossover if the trend continues.

Time-Frame Signals:

1-Year Signal: Hold. The upward trend suggests continued growth potential, but the recent pullback and weakening momentum indicate caution.

2-Year Signal: Buy. Given the strong recovery from mid-2022 and current support levels, there is potential for continued upward movement once the correction phase stabilizes.

3-Year Signal: Buy. The long-term trend remains upward, with substantial recovery from the lows, indicating robust growth potential over a longer horizon.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Investors face a test of nerves as they brace for the coming week amid heightened economic uncertainty and market volatility. The performance of big tech companies and broader market indices will be closely watched, as investors seek signs of stability and growth in a challenging economic environment. With the Federal Reserve’s next moves under scrutiny and ongoing concerns about the U.S. economy’s trajectory, market participants will need to navigate a complex landscape to make informed investment decisions.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.