During Hasbro’s First Quarter 2024 Earnings Conference Call, the company outlined its successful execution of a strategic refocus on key franchises and innovation across its product lines, contributing to a robust start to the year. Key achievements include strong licensing outcomes, particularly with Monopoly Go! and Baldur’s Gate 3, which have achieved significant milestones in revenue and acclaim. Hasbro has also engaged in new licensing agreements to expand its Dungeons & Dragons (D&D) universe and celebrated D&D’s 50th anniversary with notable partnerships. The company’s asset-light entertainment model is paying off with upcoming film and TV projects, and Hasbro is seeing a reduction in inventory levels, signaling efficient operational management. Additionally, new board members were introduced, and upcoming retirements and departures from the board were announced.

Insights

- Hasbro’s focus on fewer, bigger, better strategies is proving effective.

- Licensing and digital innovation are key drivers of revenue growth.

- Operational efficiency is reflected in improved inventory and cost structures.

- Strategic partnerships and anniversary celebrations are enhancing brand engagement.

The Essence (80/20)

The core topics for comprehensive understanding of Hasbro’s strategy include:

- Strategic Refocus: Concentrating on core franchises and leveraging popular brands through licensing and digital platforms.

- Operational Efficiency: Improved balance sheetThe balance sheet is a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. More and inventory management contributing to financial stability.

- Innovative Partnerships: Expanding the reach and appeal of key properties like D&D through collaborations with other brands and sectors.

The Action Plan

- Continue Strategic Licensing: Strengthen and expand licensing agreements to tap into new markets and demographics.

- Enhance Digital Offerings: Further develop digital games and platforms to sustain engagement and increase revenue.

- Optimize Inventory Management: Maintain disciplined inventory practices to match production with demand effectively.

- Expand Brand Collaborations: Celebrate anniversaries and create engaging experiences through collaborations with other iconic brands.

Blind Spot

While focusing on major franchises and digital transformation, Hasbro must ensure not to neglect smaller, yet potentially lucrative, market segments or innovative opportunities outside its main brands which could contribute to diversification and risk mitigation.

HAS Technical Analysis

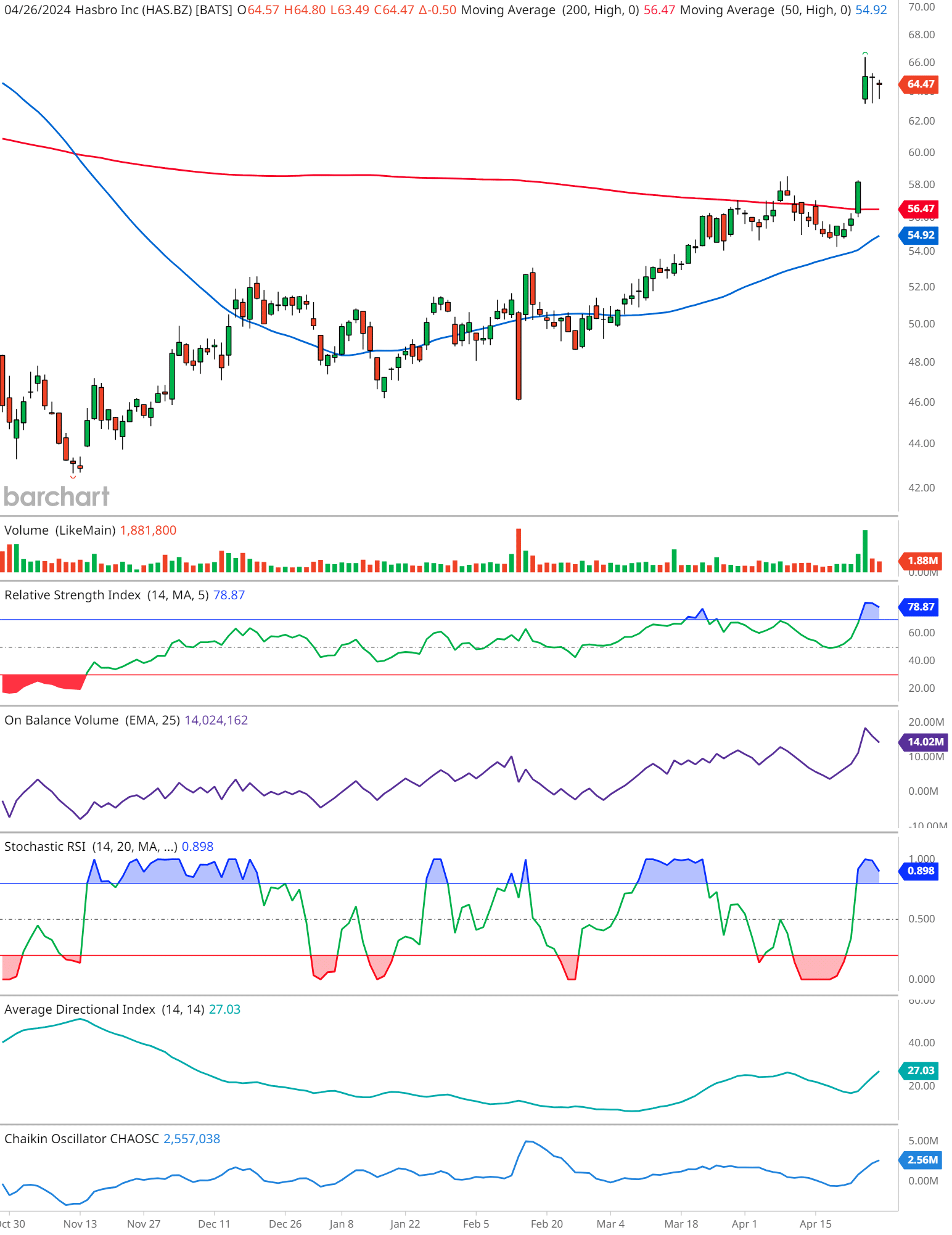

Price and Moving Averages:

- The closing price was $64.47, with a slight pullback from the high of $64.80. Hasbro’s price is above both the 50-day moving average (MA) at $54.92 and the 200-day MA, indicating a bullish trend.

Volume:

- The volume for the day was 1,881,800 shares, which is substantial and could validate the price movement.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

- The RSI stands at 78.87, indicating that Hasbro may be entering overbought territory, suggesting caution for buyers as a pullback could occur.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

- The OBV shows a steady increase with the EMA at 14,024,162, which typically confirms the ongoing uptrend in price.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

- The Stochastic RSI is at 0.898, close to the overbought threshold. This implies that the stock is currently overbought and there may be potential for a price correction.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

- The ADX stands at 27.03, which indicates a strong trend. The value above 25 often suggests a considerable trend strength, in this case, the bullish trend.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

- The Chaikin Oscillator is at 2,557,038, suggesting that buying pressure is outweighing selling pressure, aligning with the bullish momentum seen in other indicators.

General Observations:

- The price showing a spike above the moving averages and other indicators in bullish zones suggests a strong uptrend, but with the RSI and Stochastic RSI indicating overbought conditions, investors should watch for potential reversals or consolidations in the near term.

Caution:

- Considering the RSI and Stochastic RSI readings, it is important for investors to monitor for signs of a trend reversal.

Remember, past performance is not an indication of future results. It’s crucial to conduct your own research as this information is for informational purposes only and is not investment advice. ❤️

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.