Qualcomm Inc. (Nasdaq: QCOM) is leading a significant revolution in artificial intelligence (AI) at the “edge,” with their Snapdragon processors enhancing everyday devices like smartphones and PCs. Unlike competitors who focus on raw speed, Qualcomm integrates AI capabilities into its chips, resulting in smarter, more intuitive devices. These advancements allow Qualcomm’s latest Snapdragon chips to perform complex AI tasks such as real-time language translation and advanced camera features.

Qualcomm’s strategy has led to impressive market performance, with its stock surging nearly 40% year-to-date. The company is now expanding into PCs and notebooks, aiming to compete in a market traditionally dominated by Intel and AMD. Through a strategic partnership with Microsoft, Qualcomm is integrating its Snapdragon chips into Windows PCs, enhancing AI capabilities and battery efficiency.

Upcoming Windows updates will further emphasize AI, driving demand for Qualcomm’s chips. Additionally, the consumer electronics market is rebounding, with increased demand for AI-powered devices like smartphones, tablets, and wearables. Qualcomm’s focus on edge AI positions it for continued growth and leadership in the AI-driven technological revolution.

Qualcomm’s Legacy in Mobile Processing

Qualcomm is widely recognized for its Snapdragon processors, which power many of the world’s smartphones. For years, Qualcomm has been locked in fierce competition with rivals like Apple and Samsung to deliver the fastest and most power-efficient mobile chips. While the industry has often focused on raw speed, Qualcomm has pursued a different strategy. The company has been steadily integrating more AI capabilities into its chips, making our devices smarter, more intuitive, and indispensable.

The Rise of Edge AI

The results of Qualcomm’s strategy have been nothing short of impressive. The latest Snapdragon chips are capable of handling complex AI tasks, including real-time language translation, advanced camera features, and even on-device virtual assistants. Essentially, these chips are miniature AI machines, bringing sophisticated AI capabilities directly to users’ hands.

Market Recognition and Financial Performance

The market has certainly taken notice of Qualcomm’s innovations. Qualcomm’s stock has surged nearly 40% year-to-date, significantly outpacing the broader market. However, this growth appears to be just the beginning for the company.

Expanding Horizons: PCs and Notebooks

Qualcomm is not content with merely dominating the smartphone market. The company is now setting its sights on PCs and notebooks, a market traditionally dominated by Intel and AMD. This shift is largely driven by a new initiative from Microsoft, which aims to infuse its next Windows operating system with cutting-edge AI capabilities. To achieve this, Microsoft needs processors capable of handling advanced AI workloads efficiently.

Snapdragon in PCs: A Strategic Partnership with Microsoft

Qualcomm’s Snapdragon chips are uniquely suited for this task. Known for their power efficiency, these chips can run advanced AI inference tasks without rapidly draining the battery. Additionally, Qualcomm’s extensive experience in mobile optimization makes these chips ideal for thin, light, and fanless designs.

Microsoft has recognized these advantages and has been collaborating closely with Qualcomm to bring Windows on Snapdragon PCs to market. Early reviews have praised these devices for their long battery life and always-on connectivity. Qualcomm’s Snapdragon X Elite chip even outperforms some competing designs, including Apple’s flagship M3 chip, in terms of raw performance on certain benchmarks.

The Future of Windows and AI Integration

Further bolstering Qualcomm’s position are the upcoming updates to Windows, with AI expected to be a central focus. From advanced voice recognition to contextual computing, the new Windows operating system is shaping up to be an AI powerhouse. This development is set to drive significant demand for Qualcomm’s chips, as every PC maker will seek to offer AI-powered devices, turning to Qualcomm as a primary partner.

The Rebounding Consumer Electronics Market

Beyond PCs, the entire consumer electronics market is experiencing a resurgence after a prolonged slump. Smartphones, tablets, and wearables are all seeing renewed growth. As consumers look to upgrade to the latest and most advanced devices, they will seek out products with cutting-edge AI capabilities. This trend plays directly into Qualcomm’s strengths, given its deep expertise in edge AI and its broad portfolio of chips.

Insights

- Qualcomm is integrating AI into everyday devices through its Snapdragon processors.

- The company’s stock has surged 40% year-to-date.

- Qualcomm is expanding into the PC market, collaborating with Microsoft.

- The consumer electronics market is rebounding, boosting demand for AI-powered devices.

- Qualcomm’s focus on edge AI positions it for continued growth and market leadership.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

- Edge AI Integration: Qualcomm is enhancing everyday devices with advanced AI capabilities through its Snapdragon processors.

- Market Performance: Qualcomm’s strategic focus on AI has resulted in a significant stock surge and market recognition.

- Expansion into PCs: Qualcomm is entering the PC market, collaborating with Microsoft to integrate Snapdragon chips into Windows PCs.

- Consumer Electronics Growth: The rebounding consumer electronics market is driving demand for AI-powered devices, benefiting Qualcomm.

The Action Plan – What Qualcomm Should Do

- Leverage AI Capabilities: Develop and market devices with enhanced AI features to meet growing consumer demand.

- Strengthen Partnerships: Continue collaborating with key partners like Microsoft to expand into new markets.

- Focus on Battery Efficiency: Highlight Snapdragon’s power efficiency in marketing campaigns to attract more consumers.

- Invest in Innovation: Allocate resources to further AI research and development to maintain competitive advantage.

Blind Spot

While Qualcomm’s focus on AI and battery efficiency is clear, potential vulnerabilities include dependency on partners like Microsoft and competition from companies like Intel, AMD, and Apple, which could affect market share if these companies advance their AI technologies.

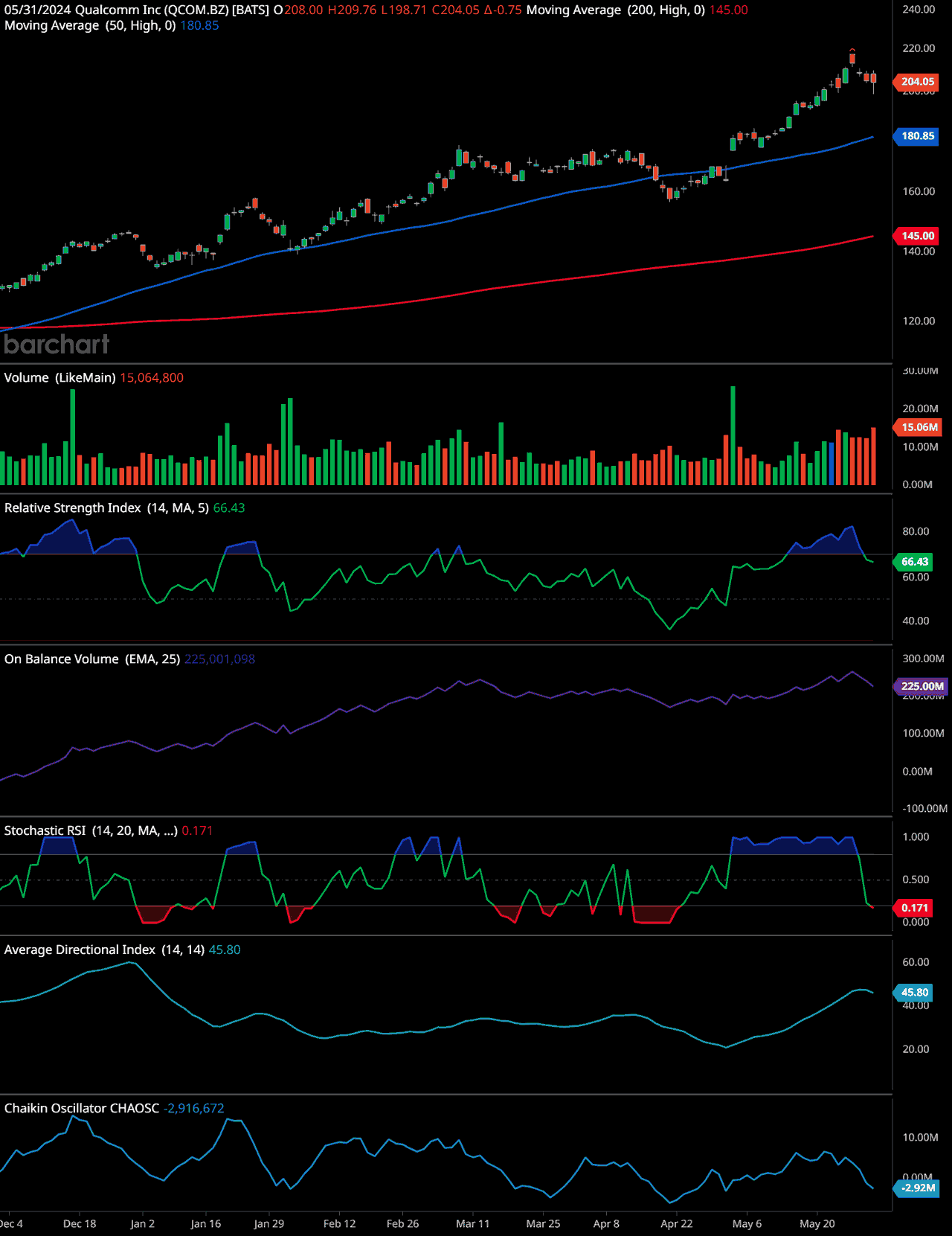

QCOM Technical Analysis

Price Trend:

The stock price shows an overall upward trend over the past few months. Recently, there has been a slight pullback from a high of around $209.76 to the current price of $204.05.

Moving Averages:

The 50-day moving average (blue line) is at $180.85, indicating strong upward momentum as the stock is trading well above this level.

The 200-day moving average (red line) is at $145.00, further confirming the long-term bullish trend since the price is significantly above this level.

Volume:

The volume chart indicates a consistent trading volume with occasional spikes. The recent spike in volume suggests increased trading activity, possibly due to the recent high price levels.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is at 66.43, which is in the neutral to slightly overbought territory. This suggests that while the stock has seen strong buying pressure, it is not yet in an extremely overbought condition.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

The OBV shows a steady increase, which supports the bullish price trend. A rising OBV indicates that the volume on up days is higher than on down days, a positive sign for future price movement.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is at 0.171, which is in the oversold region. This could indicate a potential buying opportunity if the stock reverses from this level.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

The ADX is at 45.80, indicating a strong trend. An ADX above 25 typically signifies a strong trend, and the current level suggests the upward trend is robust.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is at -2,916,672, indicating a bearish divergence. This suggests that the recent price rise might not be supported by strong accumulation, which could be a warning sign of a potential reversal or consolidation.

Summary:

The stock is in a strong upward trend with support from the 50-day and 200-day moving averages. The RSI indicates the stock is slightly overbought but not excessively. The OBV supports the upward trend, while the Stochastic RSI suggests a potential near-term buying opportunity due to oversold conditions. The ADX confirms the strength of the trend, though the Chaikin Oscillator signals a cautionary note.

Time-frame Signals:

- 3-month horizon: Hold. Given the strong upward trend and support levels, holding the stock could benefit from continued momentum.

- 6-month horizon: Buy. The stock’s bullish indicators and strong trend suggest further upside potential.

- 12-month horizon: Buy. Long-term moving averages and overall trend indicate a favorable outlook for the stock over the next year.

Remember, past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Qualcomm’s strategic focus on edge AI has positioned it at the forefront of a significant technological revolution. The company’s advancements in AI capabilities, strong market performance, and strategic partnerships with major players like Microsoft highlight its potential for continued growth. Investors who recognized the promise of Qualcomm’s edge AI technology early on have already seen substantial returns, with even greater gains likely on the horizon. As the demand for AI-powered devices continues to grow across various sectors, Qualcomm is well-positioned to lead the charge into a new era of innovation and connectivity.

Frequently Asked Questions (FAQ)

1. What is the “edge” in the context of AI?

The “edge” refers to everyday devices like smartphones, tablets, and wearables that are becoming increasingly equipped with AI capabilities, as opposed to data centers where AI has traditionally been focused.

2. How is Qualcomm positioning itself in the edge AI revolution?

Qualcomm is positioning itself as a leader in edge AI through its Snapdragon processors, which integrate advanced AI capabilities to make everyday devices smarter and more efficient.

3. What are Snapdragon processors known for?

Snapdragon processors are known for powering many of the world’s smartphones, providing fast and power-efficient mobile chips with integrated AI capabilities.

4. What AI tasks can the latest Snapdragon chips handle?

The latest Snapdragon chips can handle complex AI tasks such as real-time language translation, advanced camera features, and on-device virtual assistants.

5. How has the market responded to Qualcomm’s innovations?

The market has responded positively, with Qualcomm’s stock surging nearly 40% year-to-date, significantly outpacing the broader market.

6. What new markets is Qualcomm targeting with its AI technology?

Qualcomm is expanding into the PC and notebook markets, traditionally dominated by Intel and AMD, driven by a new initiative from Microsoft to integrate AI into the next Windows operating system.

7. Why are Snapdragon chips suitable for PCs and notebooks?

Snapdragon chips are known for their power efficiency and ability to run advanced AI tasks without rapidly draining the battery, making them ideal for thin, light, and fanless PC designs.

8. How has Qualcomm’s partnership with Microsoft impacted its position in the PC market?

Qualcomm’s collaboration with Microsoft has led to Windows on Snapdragon PCs, which have been praised for their long battery life and always-on connectivity, further strengthening Qualcomm’s position in the market.

9. What future developments are expected for Windows and AI integration?

Future updates to Windows are expected to focus heavily on AI, including advanced voice recognition and contextual computing, driving significant demand for Qualcomm’s AI-capable chips.

10. What is Qualcomm’s outlook in the consumer electronics market?

With the consumer electronics market rebounding, Qualcomm’s expertise in edge AI positions it well to benefit from the renewed growth in smartphones, tablets, and wearables, as consumers seek advanced AI capabilities in their devices.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.