AMD’s stock surged over 7% in after-hours trading on July 30, 2024, due to strong Q2 2024 financial results and an optimistic Q3 2024 revenue forecast. The company reported Q2 revenue of $5.8 billion, a 9% year-over-year increase, with adjusted earnings of $0.69 per share. This performance was bolstered by record data center revenue of $2.8 billion, driven by high demand for AI chips. For Q3 2024, AMD expects revenue of $6.7 billion, above analysts’ estimates. Key factors include increased AI chip demand, particularly for Instinct MI300 GPUs and EPYC CPUs, strategic market positioning, and significant contributions from the Xilinx acquisition, which diversified AMD’s product portfolio and boosted market share.

Key Factors for the Stock Surge

Strong Q2 2024 Financial Performance

Revenue: AMD reported revenue of $5.8 billion for the second quarter of 2024, representing a 9% increase year-over-year. This figure not only surpassed analysts’ expectations but also underscored the company’s strong market position.

Adjusted Earnings: The company posted adjusted earnings of $0.69 per share, exceeding the analysts’ estimate of $0.68 per share. This slight beat further demonstrated AMD’s financial health and operational efficiency.

Data Center Revenue: A major driver of AMD’s performance was the record revenue from its data center segment, which more than doubled year-over-year to $2.8 billion. This surge was fueled by the increasing demand for AI chips, highlighting the company’s strategic focus on high-growth areas.

Positive Future Outlook

Q3 2024 Revenue Forecast: Looking ahead, AMD provided an upbeat revenue forecast for the third quarter of 2024, projecting approximately $6.7 billion in sales. This forecast is slightly above the analysts’ estimate of $6.62 billion, indicating confidence in continued growth.

AI and Data Center Growth: AMD’s leadership in AI solutions and the strong demand for its Instinct, EPYC, and Ryzen processors are expected to drive significant revenue growth in the second half of the year. This positive outlook is bolstered by the company’s strategic investments and product development in high-performance computing.

Market Reaction

Following the earnings release, AMD’s stock jumped more than 7% in extended trading. This reflects investor confidence in the company’s robust performance and future growth prospects. The market’s reaction underscores the importance of strong financial results and forward-looking guidance in influencing stock prices.

Detailed Analysis of Data Center Revenue Surge

Significant Increase in AI Chip Demand

Instinct MI300 GPU Shipments: A major contributor to the revenue surge was the steep ramp-up in shipments of AMD’s Instinct MI300 GPUs. Designed for AI and high-performance computing applications, this product saw widespread adoption among major tech companies and cloud service providers.

EPYC CPU Sales: Additionally, there was strong growth in sales of AMD’s 4th Generation EPYC CPUs. These CPUs are widely used in data centers for their performance and efficiency, contributing significantly to the overall revenue increase.

Strategic Product and Market Positioning

AI and Data Center Focus: AMD’s strategic focus on AI and data center markets, including substantial investments in R&D, positioned the company to capitalize on the growing demand for AI solutions. This focus has enabled AMD to develop a competitive edge in these high-growth segments.

Customer Adoption: Key customers, including Microsoft, Meta, and Lenovo, have begun utilizing AMD’s latest AI chips. This customer adoption further drove revenue growth in the data center segment, highlighting the effectiveness of AMD’s strategic initiatives.

Broader Market Trends

Generative AI Boom: The rapid advances in generative AI and the development of more capable models have increased the demand for high-performance compute solutions. AMD’s data center products have benefited from these broader market trends, driving significant revenue growth.

Financial Performance

Record Revenue: The data center segment achieved record quarterly revenue of $2.8 billion, marking a 115% year-over-year increase. This accounted for nearly 50% of AMD’s total revenue for the quarter, highlighting the importance of this segment to the company’s overall performance.

Operating Leverage: Higher revenue and improved operating leverage significantly boosted the operating income of the data center segment. This, in turn, contributed to AMD’s overall financial performance, reinforcing the positive outlook for the company.

Impact of Xilinx Acquisition

Diversification and Product Expansion

Enhanced Product Portfolio: The integration of Xilinx allowed AMD to diversify its product offerings, particularly in the data center segment. Xilinx’s field-programmable gate arrays (FPGAs) and adaptive computing solutions have been instrumental in expanding AMD’s capabilities in AI and high-performance computing applications.

Embedded Solutions: Xilinx’s technology has bolstered AMD’s embedded business, which includes solutions for AI at the edge and other specialized computing needs. This diversification has helped AMD address a broader range of market demands, driving further growth in the data center segment.

Financial Impact

Revenue Growth: Since the acquisition, AMD’s data center segment has seen substantial revenue growth. For instance, in Q2 2024, the data center segment achieved record revenue of $2.8 billion, up 115% year-over-year. This growth was driven by the ramp-up of AMD Instinct GPUs and strong sales of 4th Gen EPYC CPUs, enhanced by Xilinx’s technology.

Market Share Gains: The integration of Xilinx has helped AMD gain market share from competitors like Intel, particularly in the data center and AI markets. The combined product offerings have made AMD more competitive and attractive to major tech companies and cloud service providers.

Strategic Synergies

AI and Data Center Focus: Xilinx’s expertise in adaptive computing and AI has been integrated into AMD’s strategic focus on AI and data center markets. This integration has enabled AMD to develop more advanced AI capabilities across its product portfolio, driving demand and revenue growth in these segments.

Operational Efficiency: The acquisition has also led to operational synergies, such as improved R&D capabilities and a richer product mix. This has allowed AMD to optimize its offerings and better meet the evolving needs of the data center market.

Insights

- AMD’s strategic focus on AI and data centers is paying off.

- The Xilinx acquisition significantly enhanced AMD’s product capabilities.

- Strong demand for AI chips is a major revenue driver.

The Essence (80/20)

Core Topics for Comprehensive Understanding:

- Q2 2024 Financial Performance: AMD’s Q2 revenue hit $5.8 billion, a 9% year-over-year increase, surpassing expectations, with adjusted earnings of $0.69 per share.

- Data Center Revenue Surge: Record data center revenue of $2.8 billion, driven by AI chip demand, particularly Instinct MI300 GPUs and EPYC CPUs.

- Positive Revenue Forecast: Q3 2024 revenue expected at $6.7 billion, reflecting continued confidence in AMD’s growth trajectory.

- Strategic Positioning: Emphasis on AI and data centers, with substantial R&D investments and key customer adoption (Microsoft, Meta, Lenovo).

- Xilinx Acquisition Impact: Enhanced product portfolio, diversification, and strategic synergies leading to market share gains and revenue growth.

The Action Plan – What AMD Will Likely Do Next

Strengthen Customer Relationships: Maintain and expand partnerships with key clients like Microsoft, Meta, and Lenovo.

Leverage AI and Data Center Expertise: Continue investing in AI and high-performance computing solutions to capitalize on growing demand.

Expand Market Reach: Target more tech companies and cloud service providers with advanced AI and data center products.

Optimize Product Portfolio: Integrate Xilinx technology further into AMD’s offerings to enhance capabilities and meet diverse market needs.

Blind Spots with Remediations

Supply Chain Vulnerabilities

Blind Spot: AMD’s reliance on a complex supply chain for high-performance chips can be a risk, particularly if there are disruptions in production or logistics.

Remediation: Diversify suppliers and geographic locations for key components. Establish strategic reserves of critical materials and invest in supply chain resilience technologies.

R&D Investment Risks

Blind Spot: While heavy investment in R&D is crucial for innovation, it can also lead to financial strain if the anticipated returns are not realized.

Remediation: Implement a balanced R&D portfolio with short-term and long-term projects. Regularly review and adjust R&D investments based on performance metrics and market trends.

Market Saturation in AI and Data Centers

Blind Spot: The rapid growth in AI and data center markets might lead to saturation, increasing competition and compressing margins.

Remediation: Continuously innovate and differentiate products. Explore adjacent markets and applications for AI and high-performance computing to expand revenue streams.

Customer Concentration Risk

Blind Spot: Significant revenue dependency on a few major customers like Microsoft, Meta, and Lenovo could be a risk if any of these customers reduce their orders or switch to competitors.

Remediation: Diversify the customer base by targeting a broader range of clients, including small and medium-sized enterprises (SMEs). Strengthen customer relationships through exceptional service and tailored solutions.

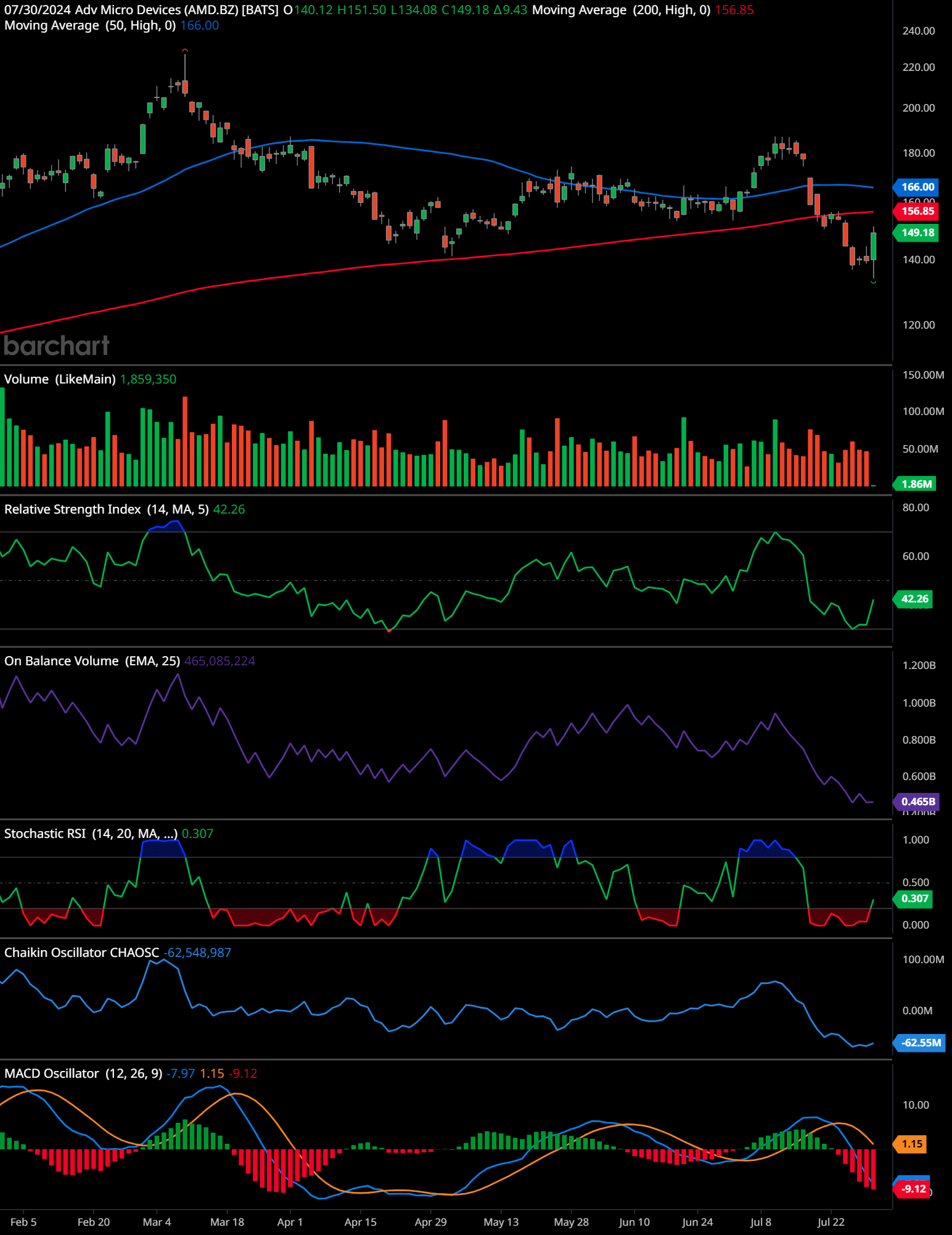

AMD Technical Analysis Daily Time Frame

The chart for Advanced Micro Devices (AMD) shows the following technical analysis:

The current price is $149.18, with the 50-day moving average at $156.85 and the 200-day moving average at $166.00. The price has recently dropped below both moving averages, indicating a potential bearish trend.

Volume: The volume has spiked recently, indicating increased trading activity, typically seen during significant price movements.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 42.26, which is below the neutral 50 level but not in the oversold territory. This suggests a slightly bearish momentum but not extreme.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV shows a declining trend, indicating that the volume on down days is greater than the volume on up days, which is bearish.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.307, which is very low and suggests the stock is oversold, indicating a potential for a short-term bounce.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -62.55M, showing a significant outflow of money, which is a bearish sign.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More: The MACD line is at -7.97 and the signal line is at 1.15, with a histogram value of -9.12. This indicates a strong bearish signal as the MACD is well below the signal line and the histogram is negative.

Key Observations:

- The stock is currently in a downtrend as it is trading below both the 50-day and 200-day moving averages.

- The volume increase suggests high trader interest, likely due to the significant price movements.

- The RSI and Stochastic RSI indicate the stock is nearing oversold levels, which could lead to a short-term rebound.

- Both OBV and Chaikin Oscillator indicate bearish sentiment with significant selling pressure.

- The MACD is showing a strong bearish signal.

Time-Frame Signals:

12 Months: Hold – If the stock can recover and break above the moving averages, the long-term outlook might improve. However, current indicators suggest caution.

3 Months: Sell – The overall bearish indicators and downward trend suggest the stock might continue to decline in the short term.

6 Months: Hold – Given the oversold indicators, there could be a short-term rebound, but the overall trend is still bearish.

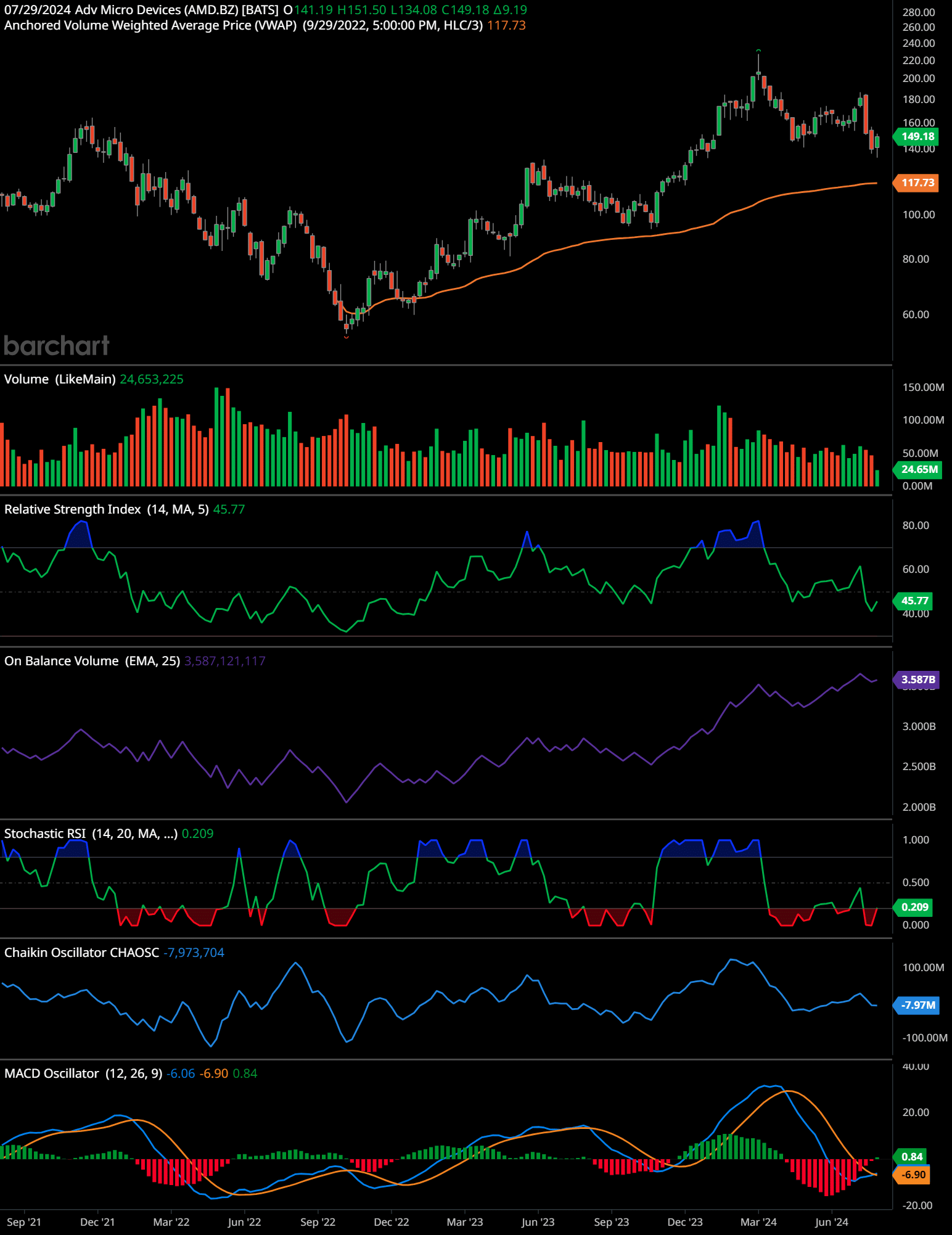

AMD Technical Analysis Weekly Time Frame

Here’s the comprehensive technical analysis of AMD (Advanced Micro Devices) in the weekly time frame.

The chart indicates an upward trend overall, with some periods of consolidation and correction. The price recently experienced a pullback but appears to be recovering. The Anchored Volume Weighted Average Price (VWAP) from September 2022 is at 117.73, acting as a support level.

Volume is relatively high, indicating strong interest in the stock. The Relative Strength Index (RSI) at 45.77 suggests the stock is in neutral territory, neither overbought nor oversold.

The On-Balance Volume (OBV) line shows a steady increase, reflecting accumulation by investors. The Stochastic RSI is very low at 0.209, indicating potential for a bullish reversal from oversold conditions.

The Chaikin Oscillator is negative at -7.973M, suggesting distribution rather than accumulation. The MACD line is below the signal line, but the histogram shows decreasing negative momentum, hinting at a possible bullish crossover soon.

Time-Frame Signals:

3 Months: Hold

The stock appears to be stabilizing after a recent pullback. It may consolidate or experience minor gains. The RSI and Stochastic RSI suggest it is not yet ready for a strong upward move.

6 Months: Buy

The technical indicators suggest the stock could gain momentum and move higher. The improving MACD and the strong OBV indicate potential for a positive trend continuation.

12 Months: Buy

Given the overall upward trend, accumulation signals, and the stock’s recovery from recent lows, a long-term investment could be favorable.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The rise in AMD’s stock price on July 30, 2024, can be attributed to the company’s strong second-quarter earnings, record data center revenue driven by AI demand, and a positive revenue outlook for the upcoming quarter. The integration of Xilinx has further enhanced AMD’s product portfolio and market position, driving significant revenue growth and market share gains. These factors collectively boosted investor confidence, leading to a significant increase in the stock price. As AMD continues to focus on AI and data center markets, it is well-positioned for continued growth and success in the future.

Frequently Asked Questions (FAQs) about AMD’s Financial Performance

- Q1: Why did AMD’s stock rise significantly in after-hours trading on July 30, 2024?

- A1: AMD’s stock experienced a significant rise due to the company’s strong second-quarter financial results and an optimistic revenue forecast for the third quarter.

- Q2: What were the key financial results for AMD in Q2 2024?

- A2: AMD reported revenue of $5.8 billion, a 9% increase year-over-year, and adjusted earnings of $0.69 per share, beating analysts’ expectations.

- Q3: What drove AMD’s record revenue in the data center segment?

- A3: The record revenue of $2.8 billion in the data center segment was driven by surging demand for AI chips, particularly the Instinct MI300 GPUs and strong sales of 4th Generation EPYC CPUs.

- Q4: What is AMD’s revenue forecast for Q3 2024?

- A4: AMD expects approximately $6.7 billion in sales for Q3 2024, slightly above analysts’ estimate of $6.62 billion.

- Q5: How did market reaction reflect AMD’s performance and future growth prospects?

- A5: Following the earnings release, AMD’s stock jumped more than 7% in extended trading, reflecting investor confidence in the company’s robust performance and future growth prospects.

- Q6: How has the demand for AI chips impacted AMD’s financial performance?

- A6: The high demand for AI chips, especially the Instinct MI300 GPUs, significantly boosted AMD’s data center revenue, contributing to the company’s overall strong financial performance.

- Q7: What role did the acquisition of Xilinx play in AMD’s data center revenue growth?

- A7: The acquisition and integration of Xilinx enhanced AMD’s product portfolio and capabilities in AI and high-performance computing, contributing to substantial revenue growth in the data center segment.

- Q8: How did AMD’s strategic focus on AI and data center markets influence its financial results?

- A8: AMD’s strategic investments in AI and data center markets positioned the company to capitalize on growing demand, driving significant revenue growth and record data center revenue.

- Q9: Which major tech companies have adopted AMD’s latest AI chips?

- A9: Key customers such as Microsoft, Meta, and Lenovo have begun utilizing AMD’s latest AI chips, further driving revenue growth in the data center segment.

- Q10: What broader market trends have benefited AMD’s data center products?

- A10: The rapid advances in generative AI and the development of more capable models have increased the demand for high-performance compute solutions, benefiting AMD’s data center products.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.