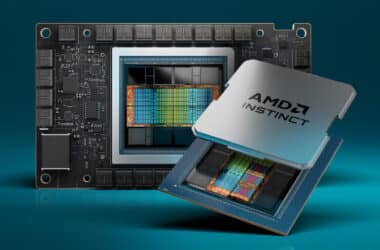

Texas Instruments (TXN), a prominent semiconductor manufacturer, has recently reported its Q4 results and provided guidance for Q1. While the Q4 results were generally in line with consensus, the company’s bearish Q1 guidance has led to a minor pullback in its stock price. In this article, we will delve into the key aspects of TXN’s recent performance, the challenges it faces, and the outlook for the semiconductor industry.

Challenging Demand Environment

One of the notable concerns highlighted by investors is the persistently weak demand environment, particularly in the semiconductor maker’s largest end market, industrials. This challenging environment has led to selling pressure not only on TXN but also on many of its industry counterparts, including Analog Devices (ADI), Microchip (MCHP), and STMicroelectronics (STM).

Gross Margin Compression

In Q4, TXN experienced a significant gross marginGross margin is a critical financial metric that plays a pivotal role in evaluating a company's financial health and profitability. It is a percentage that indicates how efficientl... compression, with margins falling by 650 basis points year-over-year (YoY). This decline followed a 320 basis point drop in Q4 2022, resulting in a gross margin of 60%. Several factors contributed to this margin pressure, including lower revenue, increased manufacturing costs related to planned capacity expansions, and reduced factory loadings. These headwinds have been weighing on margins for over a year.

TXN has been committed to investing in capacity expansion, with a target of approximately $5.0 billion in capital expenditures (CapExIn the realm of corporate finance, Capital Expenditure (CapEx) play a crucial role in shaping the future trajectory of a company. From acquiring new assets to upgrading existing in...) each year through 2026. As a result, the impact on margins from these investments was likely anticipated by the company. Management had also previously mentioned a supply/demand imbalance, leading to greater underutilization, which continued into Q4.

Revenue Decline

The need to counterbalance margin pressure required TXN to achieve robust top-line growth. However, despite its efforts, demand remained weak. Total revenue declined YoY for the fifth consecutive quarter, dropping by 12.7% to $4.08 billion, slightly below consensus expectations.

On a sequential basis, TXN faced challenges in its top two end markets: industrial (40% of FY23 revenue) and automotive (34%). Both segments experienced softness, with industrial revenue falling by a mid-teens percentage and automotive revenue declining by a mid-single-digit percentage. Personal electronics (15%) also showed no significant improvement, posting flat revenue, while the communications equipment segment (5%) declined by a low single-digit percentage. The only end market to witness growth was enterprise systems, with modest low single-digit percentage growth.

Concerns Over Automotive Market

Of particular concern was the decline in revenue from the automotive market. This segment had been a stable performer for TXN for over three years. In contrast, investors may have grown accustomed to weakness in the industrial end market, which had not seen sequential growth since 2Q22.

Bleak Q1 Guidance

TXN’s Q1 guidance has raised further concerns, projecting earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) of $0.96 to $1.16 and revenues of $3.45 to $3.75 billion. These figures are well below analyst forecasts. Management noted that its guidance reflects persistently weak economic conditions, where customers are expected to continue rebalancing their inventories. Importantly, the weakness appears to be broad-based rather than limited to a specific area.

Long-Term Optimism

Despite the current challenges, TXN remains optimistic about the long-term outlook. The company believes that its emphasis on the industrial and automotive markets will eventually result in outsized gains. Customers are increasingly turning to analog and embedded technologies to enhance reliability, affordability, and power consumption.

However, until conditions improve, particularly within the industrials segment, it may be prudent for investors to exercise caution and consider staying on the sidelines.

Navigating a Challenging Environment

Texas Instruments faces ongoing challenges in a semiconductor industry marked by weak demand, margin compression, and declining revenue in key markets. While the company maintains its long-term optimism, it is clear that the short-term outlook is clouded by economic uncertainties. TXN’s ability to navigate these challenges and return to growth will depend on various factors, including the broader economic landscape and the recovery of key end markets.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.