In the realm of business, the journey of a company often traverses through peaks of success and valleys of challenges. Docusign (DOCU), a stalwart in the digital transaction management space, recently showcased a commendable blend of financial prowess, strategic foresight, and a steadfast commitment to long-term prosperity. However, amidst the accolades, there lurk concerns pertaining to restructuring endeavors and a dip in retention rates, which warrant a deeper examination.

Triumphs in Financial Performance

Docusign’s recent financial report unveils a narrative of triumph, marked by notable achievements and impressive figures that underscore its resilience and growth trajectory. In the fourth quarter, the company reported a revenue of $712 million, representing an 8% year-over-year increase that surpassed expectations. Moreover, the full-year revenue soared to $2.8 billion, exhibiting a robust 10% growth compared to the preceding year.

The company’s non-GAAP operating marginThe operating margin is a critical financial metric that measures a company's ability to generate profit through its core operations. It provides valuable insights into a company's... witnessed a commendable improvement, reaching 25% in the fourth quarter and culminating at 26% for the full year. Such enhancements in operational efficiency not only underscore Docusign’s ability to optimize resources but also instill confidence in stakeholders regarding its sustainable growth prospects.

Furthermore, the free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More of Docusign more than doubled in fiscal ’24, surging to nearly $900 million, a testament to its financial acumen and liquidity position.

Strategic Initiatives and Global Expansion

Amidst its financial triumphs, Docusign has been actively engaged in pioneering strategic initiatives aimed at fortifying its market presence and expanding its global footprint. Notably, the company has witnessed a robust adoption of its Contract Lifecycle Management (CLM) product among enterprise customers, a testament to its relevance in meeting the evolving needs of modern businesses.

Moreover, the international segment of Docusign has emerged as a significant growth catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More, outpacing the overall revenue growth and accounting for over 27% of the business. This international expansion not only diversifies the company’s revenue streams but also positions it for sustained growth in diverse markets.

Concerns Amidst Success: Restructuring and Retention Dilemmas

However, amidst the backdrop of financial triumphs and strategic maneuvers, there exist underlying concerns that demand attention. The recent restructuring efforts, resulting in the displacement of approximately 400 employees, raise questions about the company’s internal dynamics and workforce management practices. While restructuring is often imperative for operational optimization, its implications on employee morale and organizational culture necessitate careful consideration.

Furthermore, the dip in dollar net retention to 98% in the fourth quarter raises concerns regarding customer satisfaction and loyalty. Retention rates serve as a vital barometer of a company’s ability to retain and expand its customer base, and any decline in this metric warrants proactive measures to address underlying issues.

Navigating Through Turbulence: A Glimpse of Hope

Despite the prevailing challenges and headwinds encountered by Docusign, there are glimmers of optimism amidst the turmoil. The management remains buoyed by the easing of several headwinds that emerged with the Federal Reserve’s rate-raising campaign over two years ago. Additionally, the ongoing stabilization across the company’s business operations has culminated in its highest year-over-year billings growth in over a year.

While the road ahead may be fraught with uncertainties, Docusign finds itself potentially amidst the early stages of a broader recovery. With a resilient spirit and a commitment to overcoming obstacles, the company stands poised to navigate through the turbulent waters and emerge stronger on the other side.

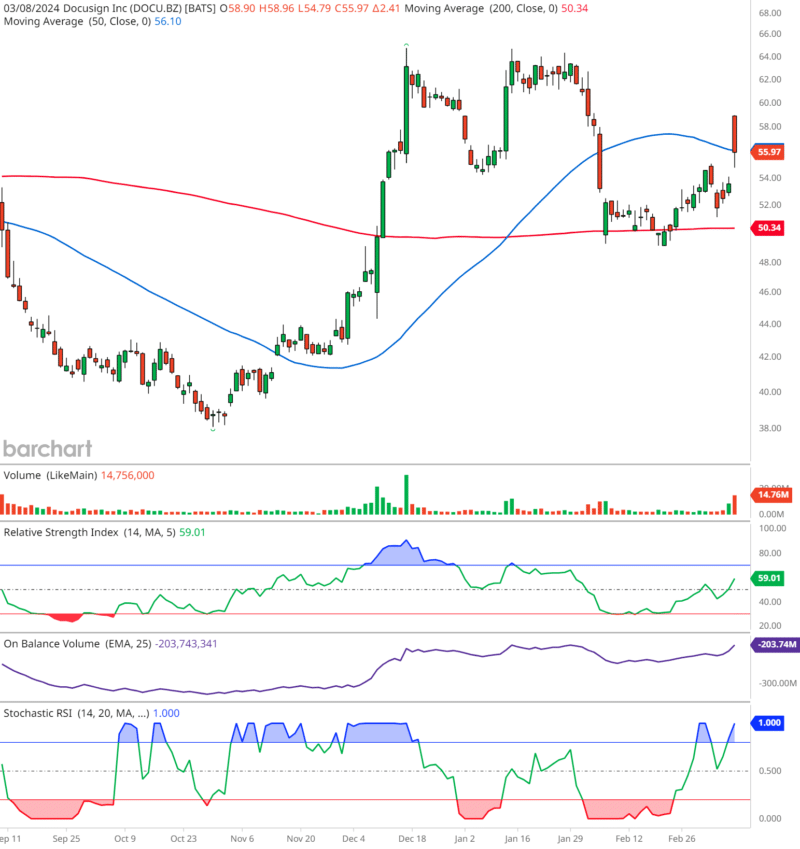

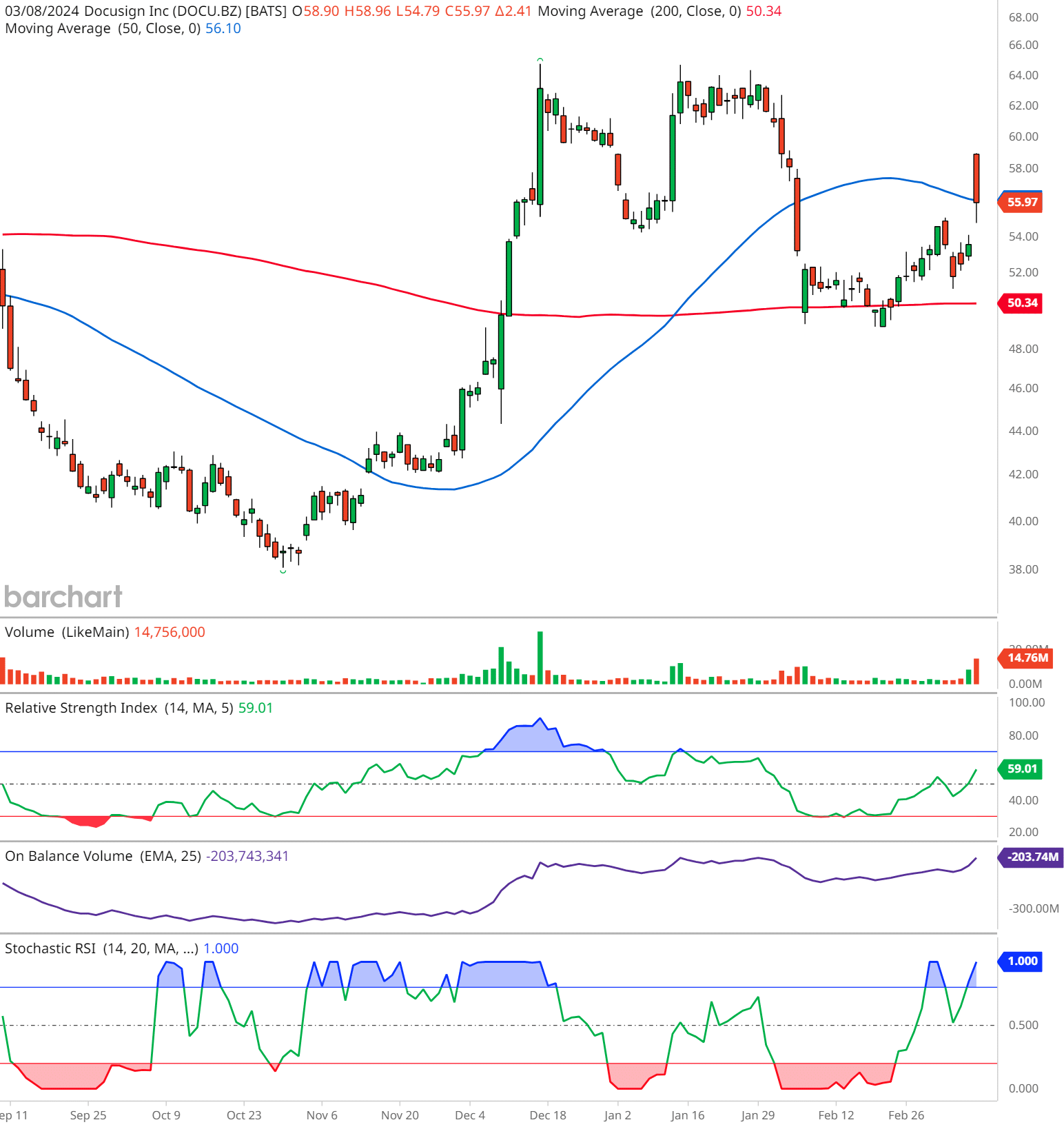

Docusign (DOCU) Technical Analysis

- The price has recently crossed below the 50-day moving average (blue line) but remains above the 200-day moving average (red line), indicating potential short-term bearishness within a longer-term uptrend.

- The relative strength indexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is near 60, which is neutral but trending towards overbought territory.

- The on-balance volumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) shows a slight increase, indicating a possible increase in buying interest.

- The stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is indicating overbought conditions as it pegs at the top of the range.

Strategy:

- Confidence Level: Moderate

- Trading Strategy: Hold/Wait for Confirmation

- Entry Point: Look for a bounce off the 200-day moving average or a clear trend reversal signal for a long position.

- Exit Point: If already holding a position, consider setting a protective stop below the 200-day moving average, or at a recent swing low around $52 for risk management.

Keep monitoring the volume and RSI for signs of momentum change. If you see a consistent downward trend in OBV along with a break below the 200-day moving average, it might indicate a stronger bearish trend, warranting a reevaluation of the position.

In conclusion, Docusign’s journey epitomizes the intricate interplay between triumphs and tribulations that characterize the corporate landscape. While its commendable financial performance and strategic initiatives underscore its resilience and adaptability, the challenges of restructuring and retention underscore the need for continuous introspection and remedial action. As Docusign charts its course forward, it remains steadfast in its pursuit of long-term success and shareholder value creation.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.