Super Micro Computer (SMCI) stock has been rising due to several factors related to the booming AI industry. Key developments include its upcoming inclusion in the Nasdaq-100 Index, replacing Walgreens Boots Alliance. The company has shown strong financial performance, with a 200% increase in revenue year-over-year and a 38% rise in non-GAAP earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g.... SMCI benefits from the growing demand for AI technologies, gaining market share through collaborations with major AI chipmakers and making significant expansion efforts. Analysts are bullish on the stock, expecting further growth. The AI server market is projected to grow rapidly, with significant increases in revenue and shipments expected over the next few years.

Nasdaq-100 Uplisting

Major Index Inclusion

Super Micro Computer is set to join the prestigious Nasdaq-100 Index (NDX) before the markets open on Monday, July 22, 2024. This inclusion comes as the company replaces Walgreens Boots Alliance (NASDAQ: WBA) in both the Nasdaq-100 Index and the Nasdaq-100 Equal Weighted Index (NDXE). This milestone reflects Super Micro’s growing prominence in the tech industry and its substantial stock rally of over 200% in the past year. The company’s inclusion in indices such as the Nasdaq-100 Tech Sector Index (NDXT) is also anticipated at the next quarterly rebalancing.

Financial Performance

Record-Breaking Results

In its latest quarterly report, Super Micro Computer achieved exceptional financial results. The company reported a staggering 200% year-over-year increase in revenue and a 38% rise in non-GAAP earnings per share. This robust financial performance underscores the company’s ability to capitalize on the increasing demand for AI technologies and high-performance computing solutions.

AI-Driven Demand

Leading Provider of AI Servers

Super Micro is benefiting immensely from the accelerating adoption of AI technologies. As a leading provider of high-performance servers used for AI, data centers, and other accelerated computing applications, the company is at the forefront of the AI revolution. The demand for these servers is driven by the need for sophisticated AI models in various industries, including healthcare, finance, autonomous vehicles, and natural language processing.

Market Share Gains

Strategic Collaborations

Super Micro has been gaining market share from larger rivals, thanks in part to its strategic collaborations with major AI chipmakers. These partnerships provide the company with early access to highly sought-after processors, enabling it to offer cutting-edge solutions to its customers. As a result, Super Micro is increasingly becoming a go-to provider for high-performance AI servers.

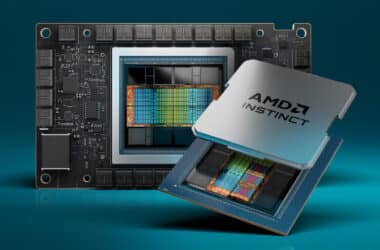

Industry Growth

Explosive Market Expansion

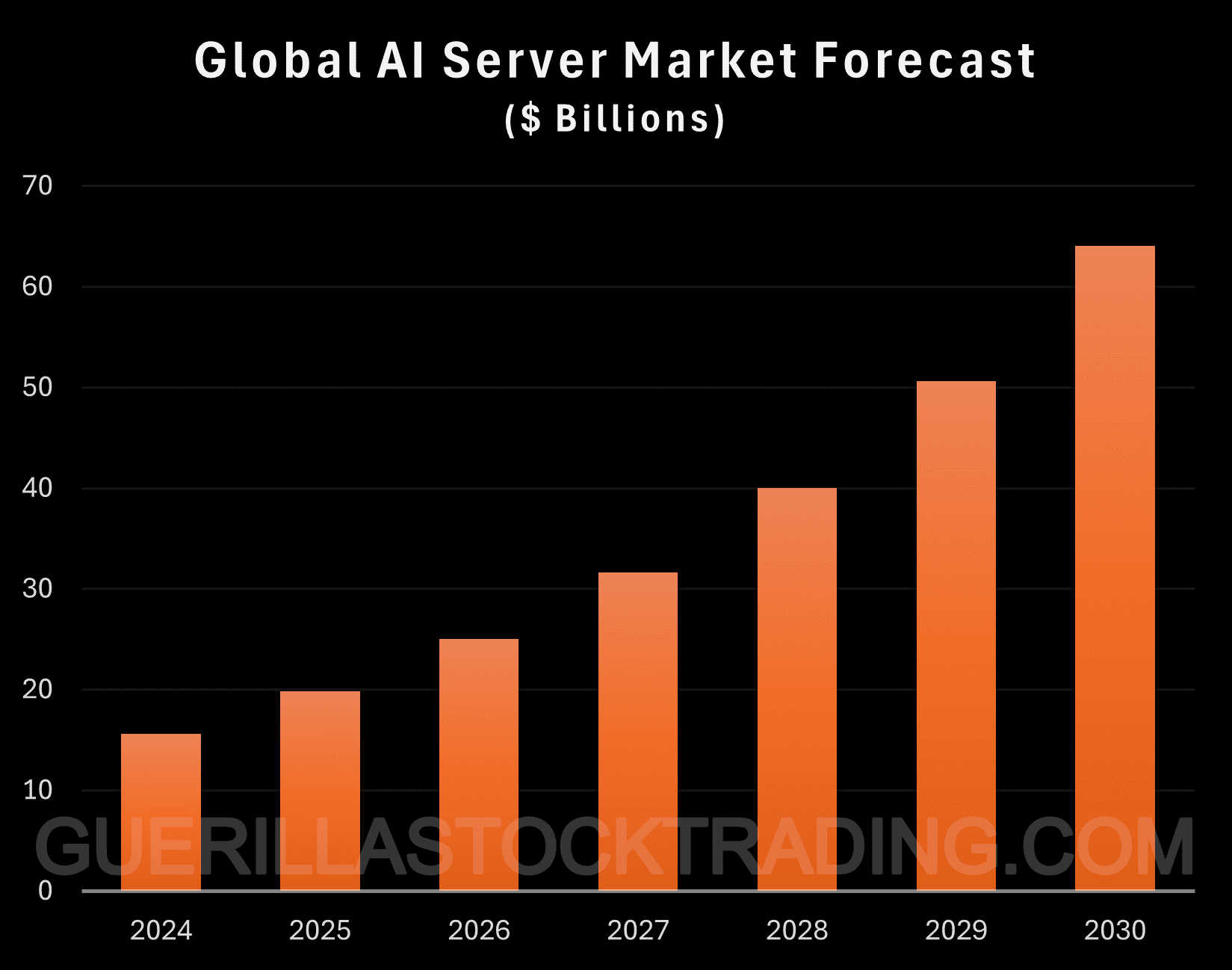

The AI server market is poised for rapid growth, with analysts predicting a 75% annual growth rate over the next three years. The global AI server market is projected to grow from $12.34 billion in 2023 to $64 billion by 2030, representing a compound annual growth rateThe world of finance is replete with complex concepts, but one that stands as a cornerstone for investors seeking to gauge returns is the Compound Annual Growth Rate (CAGR). Often ... (CAGR) of 26.54%. Similarly, AI server shipments are anticipated to increase to 6.25 million units by 2029, highlighting the expansive demand for these technologies.

Positive Analyst Coverage

Bullish Sentiment

Wall Street analysts have been notably bullish on Super Micro Computer, with many initiating or maintaining buy ratings and setting high price targets for the stock. This positive analyst coverage is a testament to the company’s strong market position and its potential for continued growth in the AI compute market.

Expansion Efforts

Meeting Surging Demand

Super Micro is making significant investments in various areas, including production, operations, management software, cloud features, and customer service. These expansion efforts are aimed at meeting the surging demand for its high-performance servers and maintaining its competitive edge in the market.

Broader AI Market Momentum

Sector-Wide Optimism

The overall bullish sentiment in the AI sector has also benefited Super Micro Computer’s stock. Positive news from other AI-related companies, such as Broadcom and Oracle, has contributed to the sector’s momentum. This broader market optimism further bolsters Super Micro’s stock performance and underscores the pervasive growth potential within the AI industry.

Future Growth Potential

Continued Demand and Market Leadership

Despite its significant rise of over 200% year-to-date as of mid-June 2024, analysts believe that Super Micro’s stock still has room for growth. The company’s strong position in the AI compute market and the expected continued demand for AI-related technologies position it well for sustained success.

AI Server Market Projections

The global AI server market is expected to reach $50.65 billion by 2029, growing at a CAGR of 26.54%. The AI and semiconductor server GPU market is predicted to grow from $16.6 billion in 2023 to $134.9 billion by 2031, at a CAGR of 30.2%. This forecasted growth underscores the strong and increasing demand for high-performance servers used for AI applications across various industries and regions.

Insights

- SMCI’s inclusion in the Nasdaq-100 boosts its market visibility.

- Strong financial performance underscores the company’s growth potential.

- Collaborations with AI chipmakers enhance SMCI’s competitive edge.

- Analysts’ bullish outlook supports positive investor sentiment.

- Rapid growth in the AI server market presents ongoing opportunities.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

Core Topics:

- Nasdaq-100 Inclusion: Enhances market visibility and investor confidence.

- Financial Performance: Record-breaking revenue and earnings growth.

- AI Demand: Increasing adoption of AI technologies fuels demand for SMCI’s high-performance servers.

- Market Share Gains: Collaborations with AI chipmakers and early access to processors.

- Industry Growth: Rapid expansion of the AI server market.

- Analyst Coverage: Positive ratings and high price targets from Wall Street analysts.

- Expansion Efforts: Investments in production, management software, and customer service.

The Action Plan – What Super Micro Computer Will Do Next

- Monitor Financial Performance: Track quarterly reports for continued revenue and earnings growth.

- Leverage Nasdaq-100 Inclusion: Utilize increased visibility for strategic partnerships and investor engagement.

- Capitalize on AI Demand: Focus on innovation and product development to meet growing AI server needs.

- Strengthen Collaborations: Maintain and expand partnerships with AI chipmakers.

- Invest in Expansion: Allocate resources to enhance production capabilities and customer service.

- Engage Analysts: Regularly update and inform analysts to sustain positive coverage.

Blind Spots

While the focus is on financial performance and market share gains, potential challenges such as supply chain disruptions, technological advancements by competitors, and geopolitical risks may be overlooked. These factors could impact SMCI’s growth trajectory and need to be closely monitored.

Regulatory and Compliance Risks: As the AI industry grows, it is likely to face increased regulatory scrutiny regarding data privacy, security, and ethical use of AI. Changes in regulations could impact SMCI’s operations and require adjustments to its business practices.

Technological Obsolescence: The rapid pace of technological advancements in AI and computing could render current high-performance servers outdated quickly. Continuous innovation is required to keep up with emerging technologies and maintain a competitive edge.

SMCI Technical Analysis

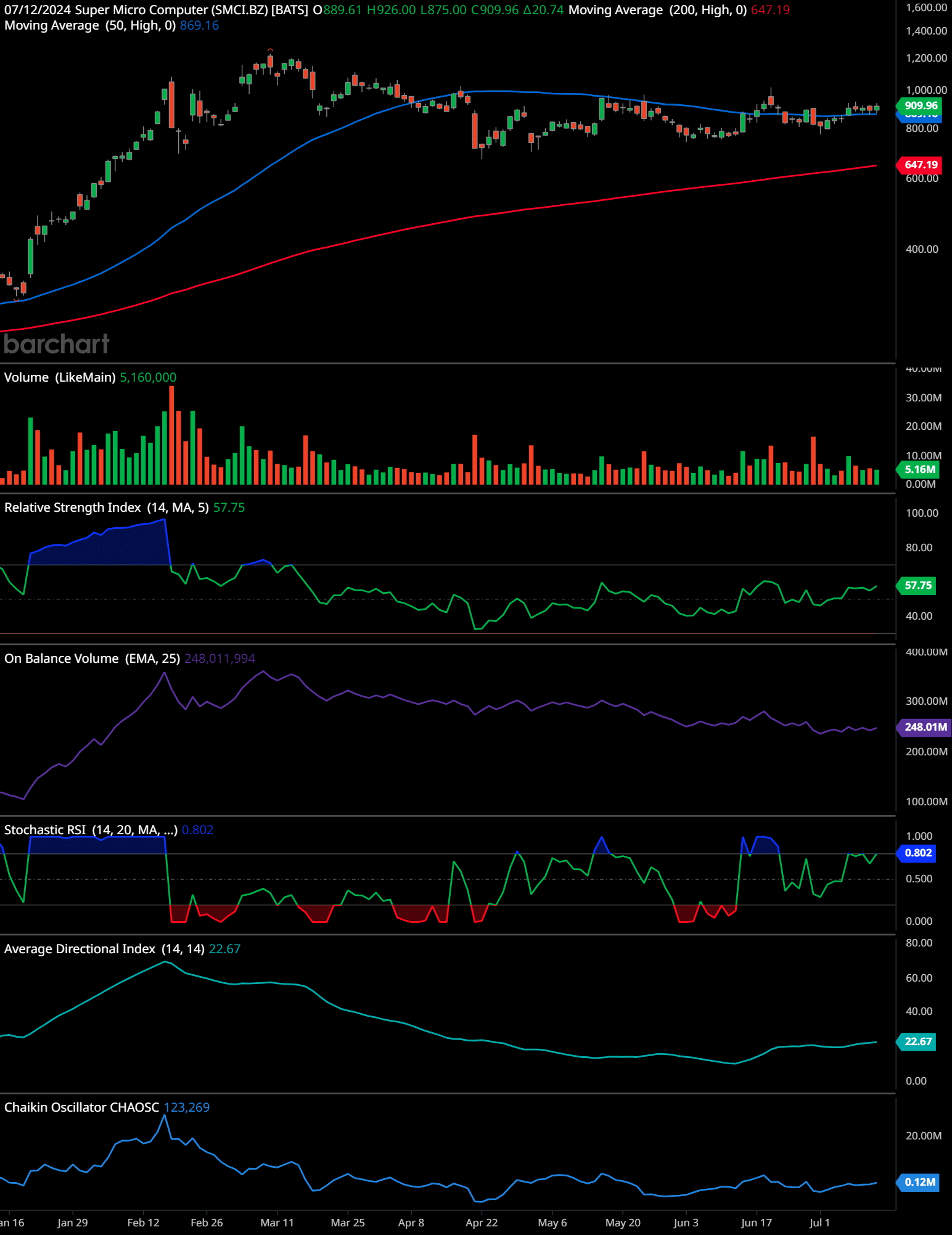

The chart for Super Micro Computer (SMCI) as of 07/12/2024 shows several key technical indicators. The price is currently at $909.96, with the 50-day moving average at $869.16 and the 200-day moving average at $647.19. The stock price has been trading above the 50-day moving average, suggesting a bullish trend in the short term, but it is also significantly above the 200-day moving average, indicating long-term bullish momentum.

Volume analysis shows a recent increase to 5.16 million, which may indicate heightened interest and potential continuation of the current trend. The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is at 57.75, which is in the neutral zone, suggesting that the stock is neither overbought nor oversold at the moment.

The On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) is relatively stable at 248 million, implying that the buying and selling volumes are balanced. The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is at 0.802, indicating a possible bullish signal as it is above 0.8.

The Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX) is at 22.67, which suggests a weak trend. This implies that while the price is currently moving upwards, the strength of this trend is not particularly strong.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is at 123,269, which is positive and suggests that buying pressure might be stronger than selling pressure.

In summary, the technical indicators suggest a generally bullish outlook for SMCI with a moderate strength trend. The stock appears to have room for growth, but the trend is not particularly strong.

Time-Frame Signals:

- 3 months: Hold

- 6 months: Buy

- 12 months: Buy

Please note that past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Super Micro Computer’s remarkable ascent in the stock market is underpinned by its strategic positioning in the AI industry, robust financial performance, and expanding market share. As the AI server market continues to grow at an impressive pace, Super Micro is well-positioned to capitalize on this momentum and maintain its leadership in the high-performance computing sector. With a bright future ahead, the company’s stock remains a compelling investment opportunity for those looking to benefit from the AI revolution.

Super Micro Computer (SMCI) Stock FAQ

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.