Renesas Electronics, a prominent Japanese chipmaker specializing in automotive semiconductor solutions, has recently announced its acquisition of Altium, an Australian printed circuit board (PCB) design automation software company, in a deal worth $5.9 billion. This strategic move marks Renesas’ third multi-billion-dollar acquisition, further solidifying its position in the semiconductor market.

Understanding Altium: A Leader in PCB Design Automation

Altium, established in 1985, has emerged as a key player in the PCB industry, offering innovative automation software solutions for designing printed circuit boards. With a focus on simplifying the design process and enhancing efficiency, Altium’s software has gained widespread recognition and adoption among electronics manufacturers worldwide. The acquisition of Altium aligns with Renesas’ strategic vision to expand its capabilities in electronic system design and life cycle management.

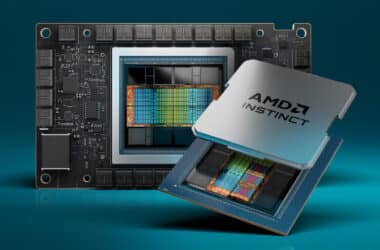

Renesas’ Strategic Expansion: A Track Record of Acquisitions

This acquisition represents a continuation of Renesas’ strategy to expand its portfolio and strengthen its position in the semiconductor market. Renesas has a history of strategic acquisitions, with Altium being the third multi-billion-dollar purchase in recent years. In 2016, Renesas acquired chipmaker Intersil for $3.2 billion, followed by the acquisition of Integrated Device Technology for $6.7 billion in 2018. More recently, Renesas acquired Dialog Semiconductor for $5.9 billion in 2021, demonstrating its commitment to growth and diversification.

The Significance of the Altium Acquisition

The acquisition of Altium underscores Renesas’ focus on advancing technology and addressing the evolving needs of the electronics industry. By integrating Altium’s PCB design automation software into its offerings, Renesas aims to enhance its ability to deliver comprehensive solutions for electronic system design and management. This strategic synergy will enable Renesas to better serve its customers and strengthen its competitive position in the market.

Renesas’ Vision for the Future

In a statement regarding the acquisition, Renesas highlighted the increasing complexity of electronic systems design and integration in today’s technological landscape. By partnering with Altium, Renesas aims to establish an integrated and open electronics system design and life cycle management platform. This shared vision reflects Renesas’ commitment to innovation and collaboration in driving the advancement of semiconductor technology.

Renesas: A Legacy of Innovation

Renesas Electronics traces its roots back to 2010 when NEC’s chip division merged with Renesas Technology, formed through the merger of Hitachi and Mitsubishi Electric’s chip operations. Since its inception, Renesas has been at the forefront of semiconductor innovation, delivering cutting-edge solutions for automotive, industrial, and IoT applications. The acquisition of Altium represents another milestone in Renesas’ journey towards shaping the future of electronics.

A Strategic Step Forward

In conclusion, Renesas Electronics’ acquisition of Altium marks a strategic step forward in the semiconductor industry. By combining forces with Altium, Renesas aims to strengthen its capabilities in electronic system design and accelerate innovation in PCB automation. As technology continues to evolve, this partnership underscores Renesas’ commitment to delivering comprehensive solutions that address the complex challenges of the modern electronics market. With the acquisition expected to close in the second half of 2024, Renesas is poised to embark on a new chapter of growth and leadership in the semiconductor industry.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.